Macro roundup: Returning trends

Latest Greek unemployment numbers show "active" workforce continuing to shrink

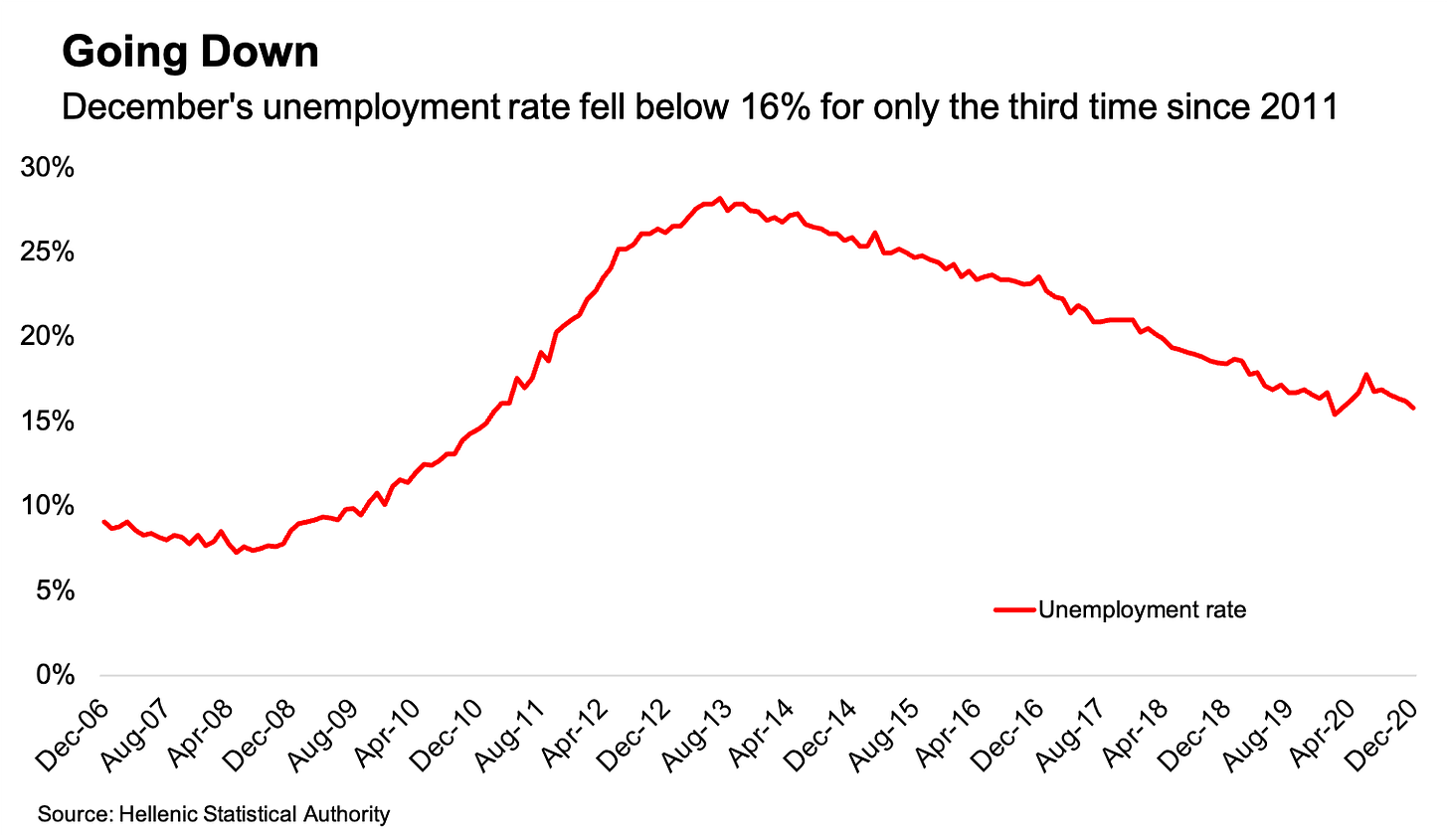

December’s unemployment figures came out this week, and they show an amplification of the trend we saw reemerging in November, of the headline rate being driven down by many jobless people not actively seeking work during the lockdown.

On its face, it is good news that Greece’s unemployment rate is back on its clear downwards trajectory, falling to 15.8 percent from 16.2 percent in November. It’s only the third reading since 2011 that’s below 16 percent, with the previous two coming in February and March, just at the outset of the pandemic in Europe.

But what we’ve seen repeatedly during the pandemic is that the drop in unemployment is happening against the backdrop of a shrinking “active” workforce. Last month we charted for the first time here the year-on-year increase in the number of people classified as economically inactive. In December, this was amplified further, with an increase of 51,500, compared with 26,700 in November.

Of course, the other thing the headline data doesn’t capture is the number of people in furlough schemes, who are classified as employed if the duration of their contract suspension is less than three months, or if they receive more than 50 percent of their salary.

Kathimerini this week reported that this affected one in three wage-earners during this second lockdown, who have lost between 30 and 35 percent of their earnings. The number of people in furlough last month was 532,208, down from 670,404 in January, according to Kathimerini.

The Finance Ministry this week released its budget execution update for February, showing the cost to the state of the furloughs was 750 million euros in the first two months of the year.

Winter freeze

Last time we looked at the unemployment figures, we noted that although more people were hired in January than fired, there was a big drop in both of these numbers, indicative of a labour market that’s freezing up. The Labour Ministry hasn’t yet provided an update in February (the report will probably drop at some point next week) but this theme has reminded me of another report from Elstat, which we did get a few weeks ago, that indicated a similar kind of freeze happening with the formation and closure of companies themselves.

The report on business demography showed that while the number of start-ups in 2020 was practically unchanged compared with 2019, the number of companies closing actually dropped by 22.7 percent.

This is in marked contrast to the mental image that’s conjured up by an economy contracting 8.2 percent — of a major depression leaving swathes of business casualties. In fact, given how the data suggest firms are staying alive that would have shut last year if the pandemic hadn’t happened, it even provides ammunition to some who wring their hands at the prospect of state support propping up zombie companies (though if there are any fanatics out there who really are willing to die on that hill, we should probably just ignore them).

If the intention behind the lockdowns was to hit the pause button on the economy, then to pick things up where they were left off, to an extent the data suggests this plan remains on track. Ultimately, however, its success will depend on how the debt overhangs that arise — private more so than public — are dealt with.

Other data

As mentioned in passing, the central government’s January to February budget execution bulletin came out this week, showing a primary deficit of 1.5 billion euros, better than its target by 1.23 billion euros. That’s a big turnaround from January, though the reasons the ministry gives for the outperformance are mostly technical, so presumably it’s just a blip.

Greek businesses obliged to keep double-entry books saw a 16.1 percent decrease in revenue in January compared with the same month of 2020, according to the latest update from Elstat.

Me, elsewhere

For those of you that just don’t get enough of me from these weekly updates: a plug for some other stuff that I have been, or will be, involved in.

Firstly, I had a chat this week with Nick Malkoutzis and Yiannis Mouzakis on The Agora podcast on the latest developments and prospects for the Greek economy. You can catch those thoughts on the site here, or here (Spotify), or here (Apple Podcasts), or here (Google Podcasts).

Then on Wednesday, March 24, at 11am, the three of us will be joined by Olivier Vardakoulias, of WWF Hellas, and Natalia Tsigaridou, of Greenpeace Hellas, for an online discussion hosted by Friedrich-Ebert-Stiftung’s Athens office. The discussion will focus on the analysis paper “The Recovery Plan in Greece”, which we wrote for the organisation.

If you’d like to follow the discussion, shoot me a response here, or write to me at marcus.bensasson@gmail.com, and I’ll forward you the invite.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key data

Tuesday:

January balance of payments (Bank of Greece)

Wednesday:

First-quarter unemployment (Elstat)

Friday:

February bank deposits and lending (Bank of Greece)

Jan-Feb. central government budget execution (Finance Ministry)

Elsewhere on the web

Nektaria Stamouli reports for Politico on how Greece is pinning its tourism recovery hopes on small islands

The IMF has a paper out looking at the use of financial incentives in debt restructuring operations, which draws some of its lessons from Greece in 2012

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.