Macro roundup: Revenue squeeze

Both businesses and the government find their finances coming under strain

Businesses are coming under increasing pressure because of the pandemic, while signs of strain continue to come from the Finance Ministry. This story has been dominating Greece’s business pages in a week that began with the question of fiscal support returning to the Eurogroup agenda.

Data this week elaborated further details on both sides of this tension, with Elstat numbers showing the size of the hit to business revenue last year, and the Finance Ministry’s budget bulletin showing public revenue continuing to come in below target at the start of 2021.

Finance Minister Christos Staikouras has advocated continuing fiscal support, and more support measures are in the pipeline for later this year. Nevertheless, each public utterance on the issue seems to come with another reminder that resources aren’t limitless, and the government is on a collision course with the catering sector, which is pursuing greater compensation for closures through the courts.

Data summary:

The Hellenic Statistical Authority released data this week showing that Greece’s businesses saw a 13.5 percent drop in their revenue last year, amounting to the loss of 41.6 billion euros. Those companies that had to suspend operations during the first lockdown suffered a fall of 36.4 percent in 2020. The accommodation sector was hit hardest with a drop of 67.5 percent.

To see one budget go off the rails because of a once-a-lifetime pandemic is unfortunate. To see a second one derailed in the first month of the next year by the same pandemic does suggest the Finance Ministry planners were rather too optimistic, whether carelessly or by design. Preliminary data for January showed the central government’s primary budget deficit for the month at 1.47 billion euros, 441 million euros wider than the target. Revenue fell 812 million euros short of its goal.

Meanwhile, the Public Debt Management Agency’s debt bulletin showed the central government’s debt rising 9.15 billion euros to 374 billion euros in the fourth quarter. Overall, the central government’s debt increased 18 billion euros last year, though 6.45 billion euros of that increase was in repos, which would net out in the consolidated general government debt.

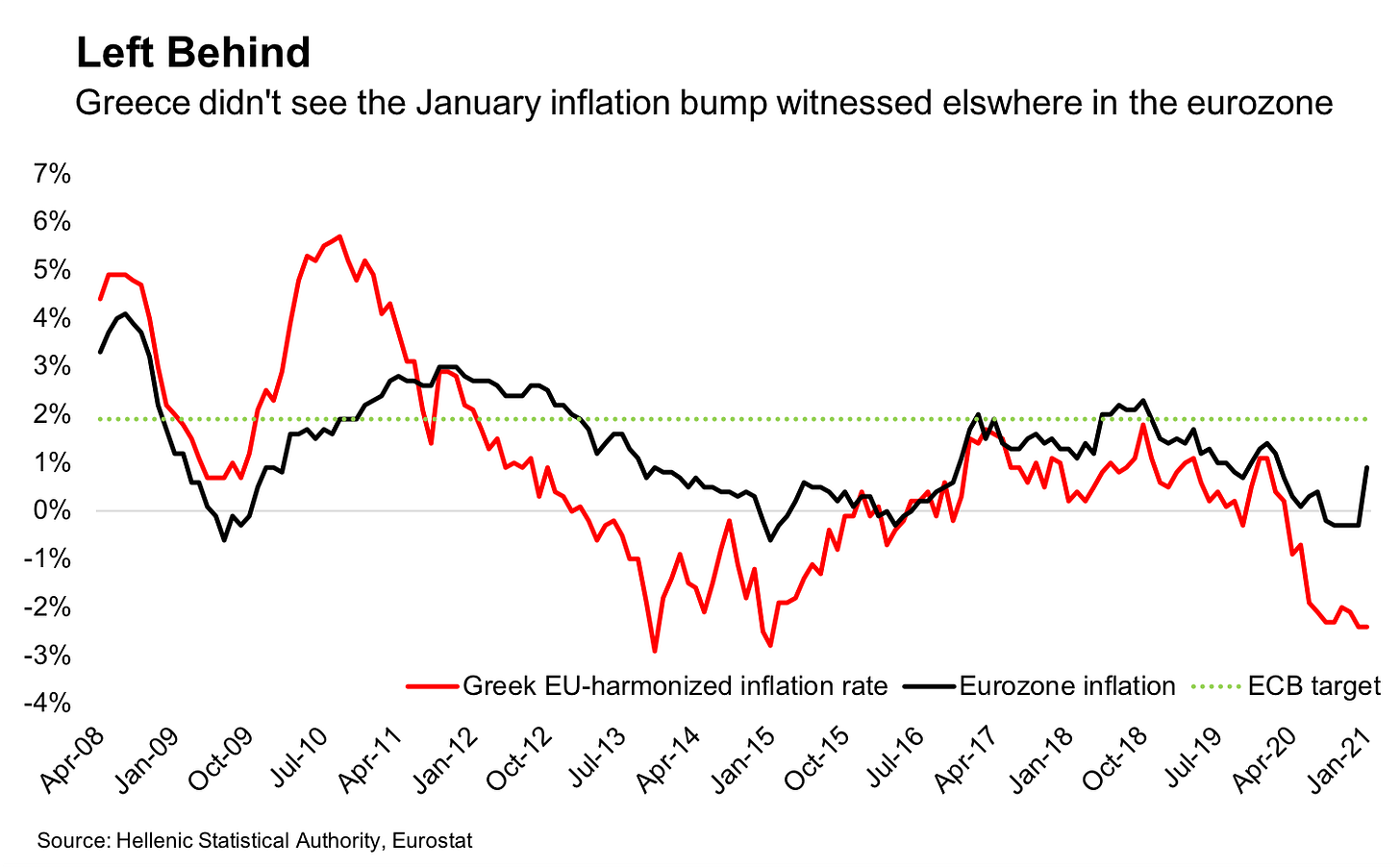

Greece’s EU-harmonised consumer price index fell 2.4 percent from a year earlier in January, its 10th straight drop. Deflation has been deeper in Greece than the rest of the euro area throughout the current crisis, but last month saw a marked divergence as the inflation rate in the currency block popped up to 0.9 percent.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key data

Monday:

December balance of payments (Bank of Greece)

Thursday:

January lending and deposits (Bank of Greece)

January central government budget execution, final data (Finance Ministry)

Friday:

December retail sales (Elstat)

Elsewhere on the web

Err … the elsewhere on the web section will be back next week.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.