Macro roundup: House price growth eases

Mini rebound boom in residential property prices seems to be drawing to an end

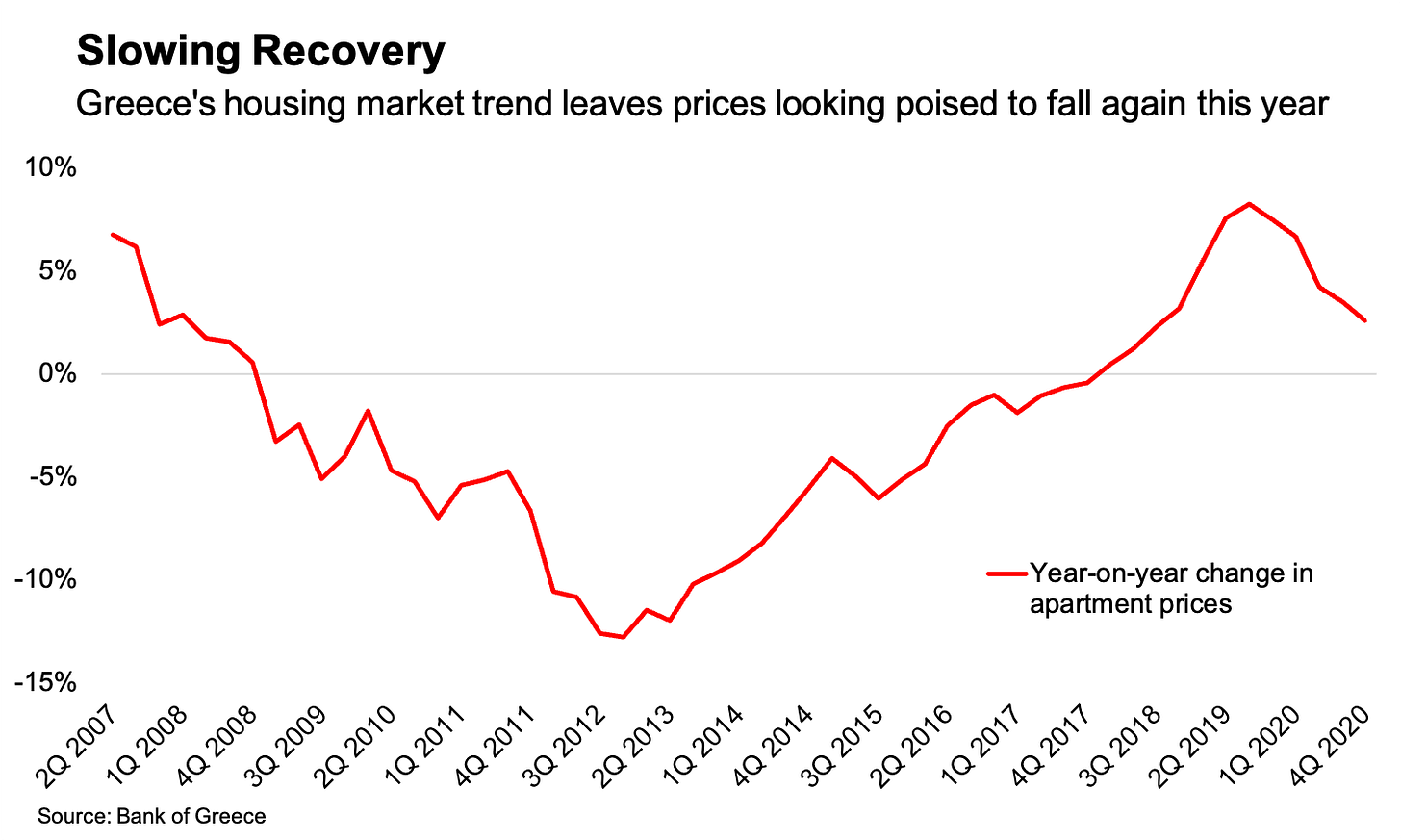

Apartment prices continued their year-on-year growth for a 12th straight quarter in the final three months of 2020, bringing the average increase for the year as a whole to 4.2 percent. That’s pretty robust growth considering what a year it was, but the pace of growth is clearly slowing, and prices actually fell in the quarter. Data this week presented a fairly similar picture for building activity, while consumer prices continued falling in February, though at a shallower rate.

Data summary:

Apartment prices rose 2.6 percent in the fourth quarter from the same period in 2019, after rising 3.5 percent in the third quarter, according to the latest Bank of Greece data.1 However, on a quarterly basis, they declined 0.4 percent, their first drop since the third quarter of 2017. House price growth is also losing breadth, falling on a year-on-year basis in non-urban parts of Greece.

Greece’s EU-harmonized consumer price index fell 1.9 percent in February after dropping 2.4 percent in January. With euro-area inflation unchanged at 0.9 percent in February, some of the gap we saw in January with the rest of the euro area has narrowed. But it’s still pretty wide.

Building activity in December, as measured by permits issued, fell 0.7 percent from a year earlier, and rose 9.2 percent for the whole of 2020. This indicator is quite spiky, making trends harder to discern than with residential property prices. But again, we’re probably seeing economic conditions catching up with Covid after a lag, with a tougher year ahead now beckoning.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key data

Tuesday:

February central government budget execution data (Finance Ministry)

Wednesday:

December unemployment (Elstat)

Friday:

January business revenue update (Elstat)

Elsewhere on the web

The latest Agora podcast from MacroPolis looks at Greece’s #MeToo moment (disclosure: I joined MacroPolis in February as its economics editor, though I haven’t been involved in producing the Agora section, which includes the pods.)

From Bruegel: the EU’s fiscal stance, its recovery fund, and how they relate to the fiscal rules

I haven’t yet listened to Zoltan Pozsar’s appearance on the Odd Lots podcast, talking about on what happened in the Treasury market (which is deeply relevant to Greece given how it led to rising bond yields), but based on his previous appearances on the show its guaranteed to be excellent.

Scientists may have solved the ancient mystery of the Antikythera mechanism

If you read FT Alphaville you may have seen this already, but central bankers singing Rick Astley is too good to not pinch from their Further Reading section

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.

In the interest of balance, after last week criticising Elstat for their last-minute change of date for the GDP data, it would be remiss of me not to mention that the Bank of Greece pretty much never puts this on its release calendar until it’s released.