Macro roundup: Greeks' real income fell in 2022

Savings rate stays negative as consumption grows 11.2 percent

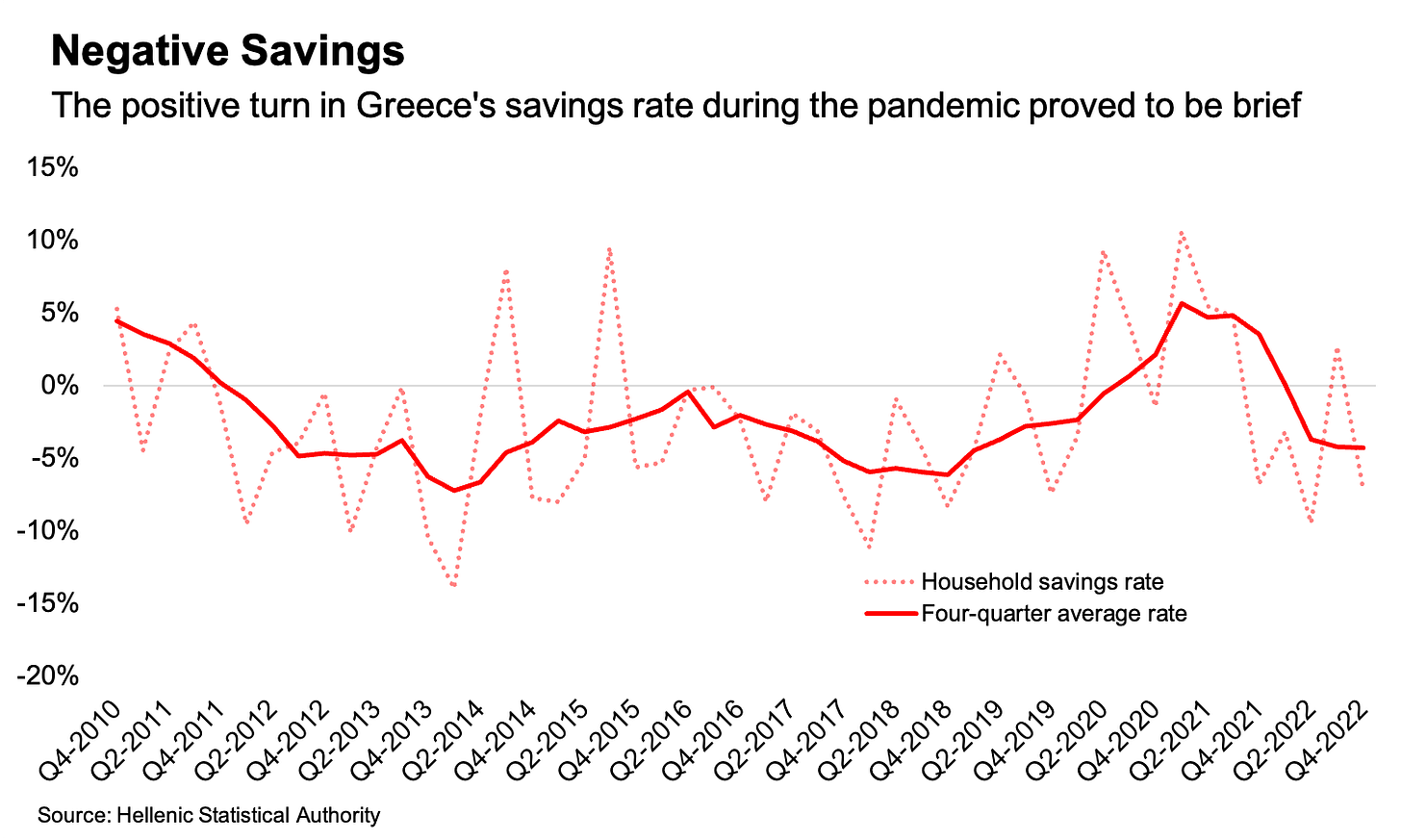

Greek households became poorer last year as a rise in disposable income fell 2.2 percent short of the average rate of inflation.

In nominal terms, disposable income increased 7.4 percent, while the average rate of price increases was 9.6 percent, according to data from the Hellenic Statistical Authority. This led to the drop in inflation-adjusted, or real, disposable income.

In the fourth quarter, disposable income increased 10.9 percent from the same period a year earlier, the biggest nominal rate of increase since 2007. As inflation had started to slow by the fourth quarter, this translated to an increase in real disposable income of 2.6 percent, compared with a drop of 2.1 percent in the previous three months.

Household consumption grew by more than income for a sixth straight quarter, increasing 11.2 percent in nominal terms.

Fiscal tailwinds

Meanwhile, on the government side, figures from the Hellenic Statistical Authority confirmed that the budget deficit last year shrank to 2.1 percent of gross domestic product, from 7.1 percent in 2021. The public debt to GDP ratio fell 23.3 percentage points to 171.3 percent.

The primary balance, which excludes interest payments, swung to a surplus of 0.1 percent of GDP from a deficit of 4.7 percent last year. This was partly due to the repatriation back to Greece of euro-area central bank profits on portfolio holdings of Greek government bonds.1

We talked last week about how the strong fiscal performance has continued into the first months of 2023, giving the government a boost in the upcoming elections:

I’ve been attending the Delphi Economic Forum this week, where Finance Minister Christos Staikouras boasted that the government was able to give the most away in subsidies to counter the increasing cost of living, while still achieving the largest fiscal adjustment in the European Union last year.

With elections now less than a month away, we’ll do a brief rundown of the main parties’ economic programmes in next week’s roundup.

Other data

Producer prices fell 10.9 percent in March from a year earlier, compared with an increase of 4.7 percent in February

Producer price inflation reached as high as 48.8 percent in April 2022

Retail sales in February increased 11.3 percent from a year earlier, compared with a rise of 10.6 percent in January

Volume increased 2.4 percent in February, compared with a 1.2 percent increase the month before

Building activity in January, as measured by the number of permits issued, increased 21.2 percent compared with the same month a year earlier

Greek economic sentiment improved in April, according to the European Commission’s economic sentiment indicator, which increased to 108.8 from 107

However, consumer confidence deteriorated to -44.6 from -41.1

Confidence in industry, retail and services all improved; construction confidence deteriorated

If you are enjoying this newsletter, then consider sharing Grecology with others.

Next week’s key releases

Tuesday, May 2:

March bank credit and deposits (Bank of Greece)

April manufacturing PMI (S&P Global)

First quarter bank lending survey (Bank of Greece)

Wednesday, May 3:

March unemployment (Elstat)

It should be noted that under Greece’s bailout programmes of the past — where the country was required to achieve and maintain large primary surpluses — these transfers wouldn’t be counted and the primary balance would be considered to be slightly in deficit.