Fiscal focus switches to debt reduction

Greece has a high stake in the debate over reforms to the EU's rulebook for deficits

The fist meetings of European finance ministers of 2022 served as a reminder that the central focus of fiscal policy discussions this year will be about how countries return to a debt-reduction trajectory.

Germany’s new finance minister, Christian Lindner, speaking before his debut at the Eurogroup meeting in Brussels this week, said that now was the time to build up fiscal buffers. European Commission Vice President Valdis Dombrovskis later stressed the need for “credible debt reduction pathways”, while also noting that agreement is starting to emerge on the pace of debt reduction.

The European Union’s Stability and Growth Pact — which sets out strict fiscal constraints that countries are supposed to follow — remains suspended until 2023. When it comes back into force it will be with some kind of revisions to debt targets that are widely-regarded as unrealistic. Lindner highlighted June as when the “real debate” on these rules will begin.

Since Greece is the country with the highest debt-to-GDP ratio in the euro area — 206 percent in 2020 — the stakes are high in this debate here.

That year, debt spiked higher, from 181 percent in 2019, due to the fiscal impact of pandemic support measures and contracting economy. The ratio is expected to have dropped back below 200 percent in 2021, mostly due to a dramatic recovery in gross domestic products.

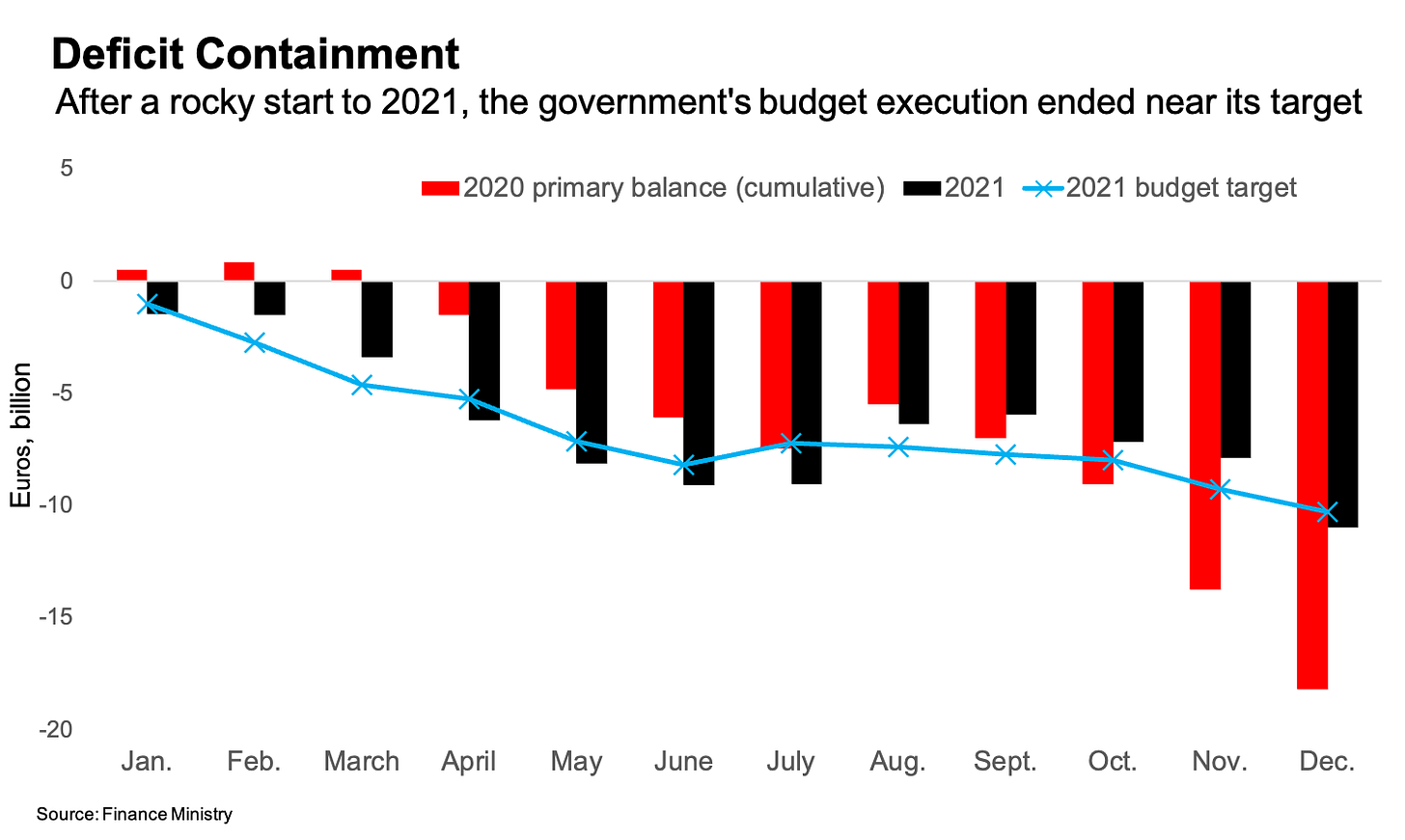

The government doesn’t expect the budget to return to a primary surplus until next year. But the full-year budget execution bulletin for 2021, which the Finance Ministry released on Monday, showed that the central government’s fiscal position already saw a significantly improvement from 2020.

The primary deficit came in at 11 billion euros, a reduction from 18.2 billion euros in 2020, and not far from the initial 2021 budget target of 10.3 billion euros. This was the result of the strong second half of the year — it’s worth remembering that the fiscal outlook at the outset of the year looked considerably bleaker than how things actually turned out.

The impulse to reduce debt isn’t just coming from European politicians.

On Friday, Fitch Ratings changed the outlook on Greece’s sovereign debt to positive, from neutral, while keeping the credit rating the same at BB, which is two levels below investment grade. The rating agency cited confidence in “a firm downward path” for the debt-to-GDP ratio among factors that could lead to an upgrade.

As noted last week, an upgrade to investment grade by one of the major credit rating agencies would make it much easier for Greece to navigate bond market conditions that are likely to get more difficult this year.

Achieving investment grade from one of the agencies by June seems optimistic — the government set 2023 as its goal. But if it does happen by then, it will help take a tiny bit of the edge off the outcome of the stability and growth pact talks for Greece.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.