Breaking down Greek inflation

Still dominated by energy, but look out for the impact of surging olive oil prices

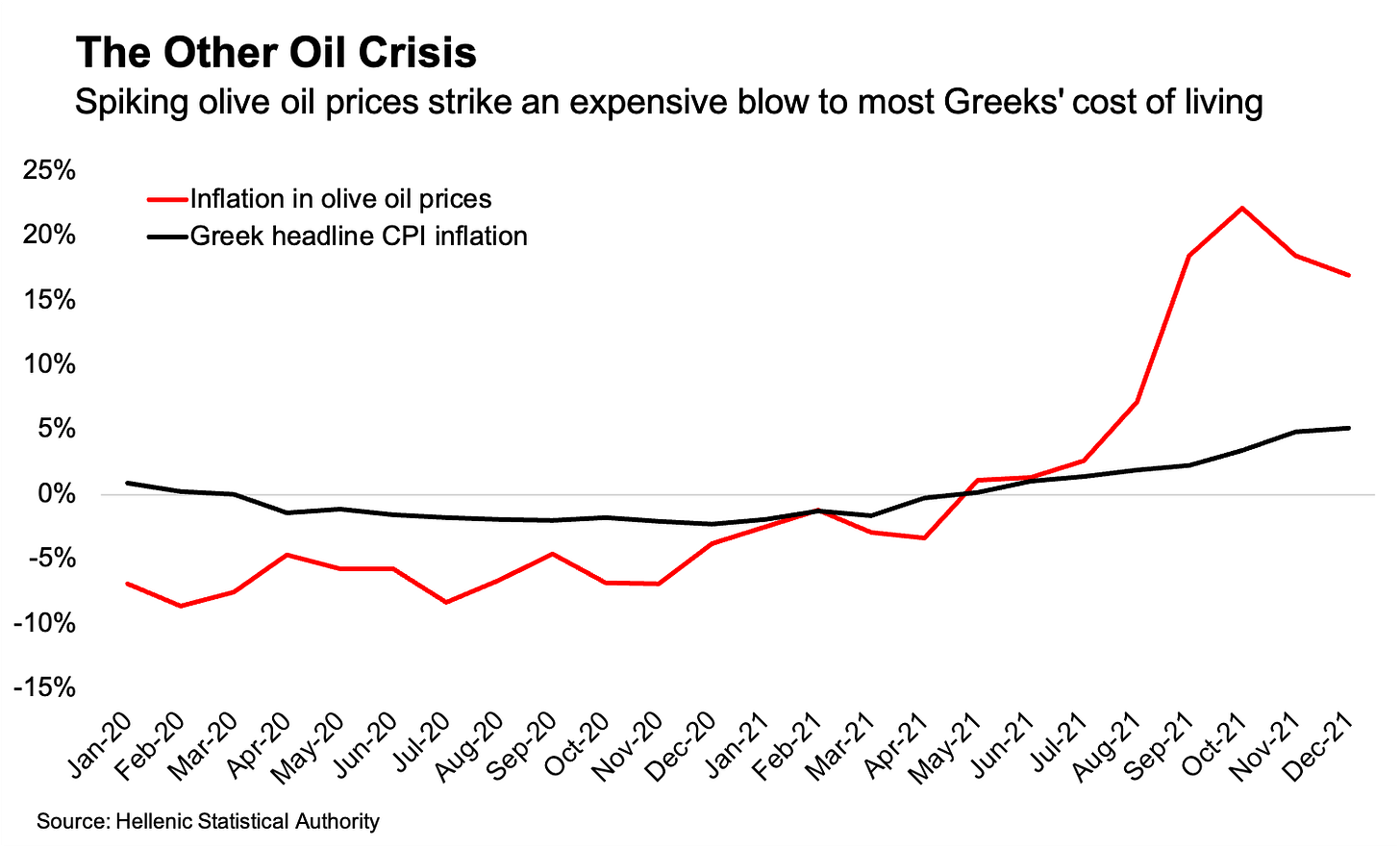

Greece’s inflation rate is at a decade high. So far it’s still overwhelmingly driven by higher energy prices, but the rising cost of olive oil could end up having more political salience than the price of crude.

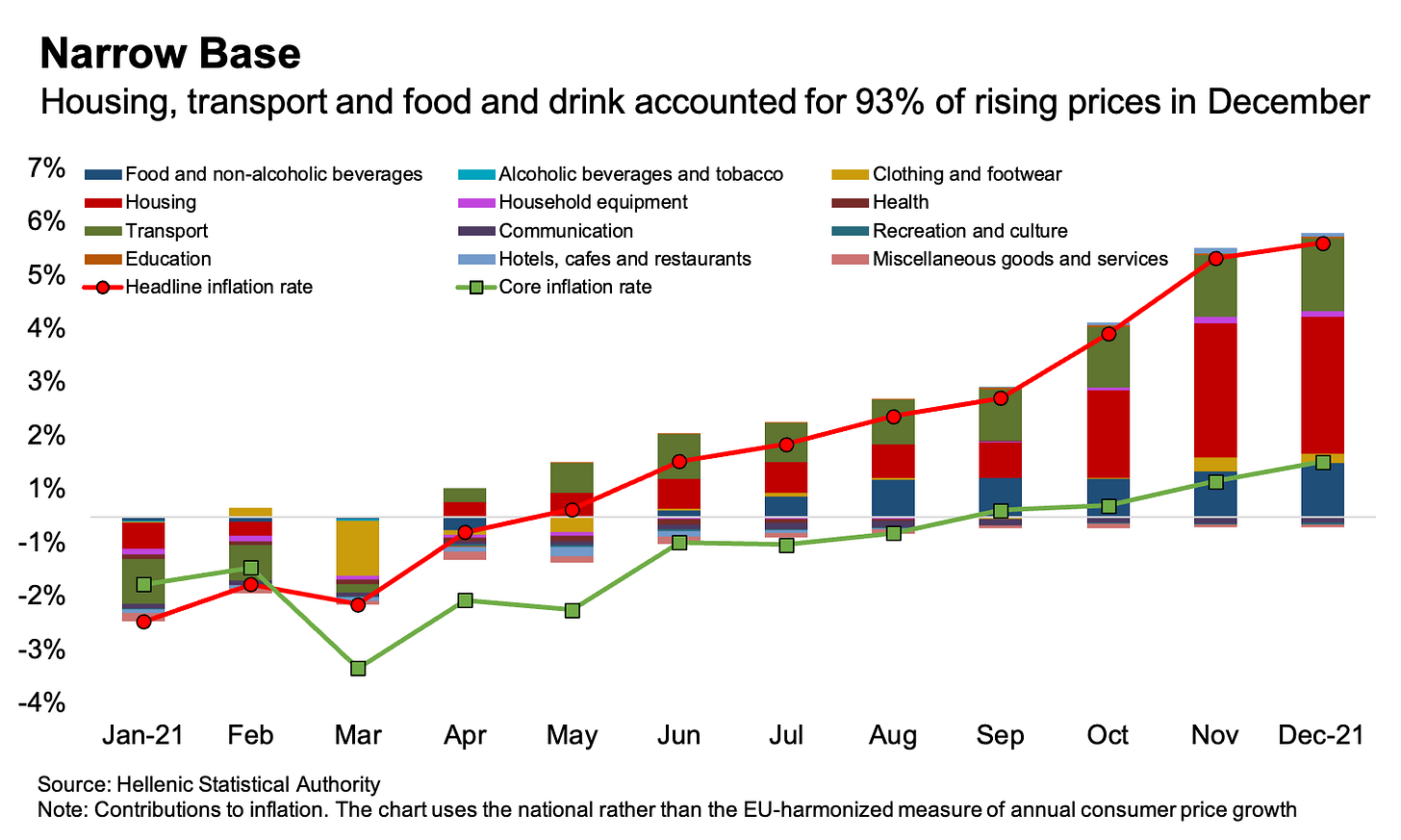

Whereas at the start of 2021 prices weren’t rising in any of the 12 categories included in the consumer price basket, by the end of the year there were growing in seven of them.1 Five of those categories saw price growth higher than 2 percent.

While inflation can be seen to be broadening, contributions to December’s 5.1 percent headline increase in the consumer price index overwhelmingly came from housing, transport and food.

Within those categories, the energy components of housing and transport are dominant, accounting for 3.5 percentage points, or two-thirds of the increase. Since energy and food prices are volatile, economists and policy makers also look at core inflation, which strips out these elements. December’s core rate was 1 percent.

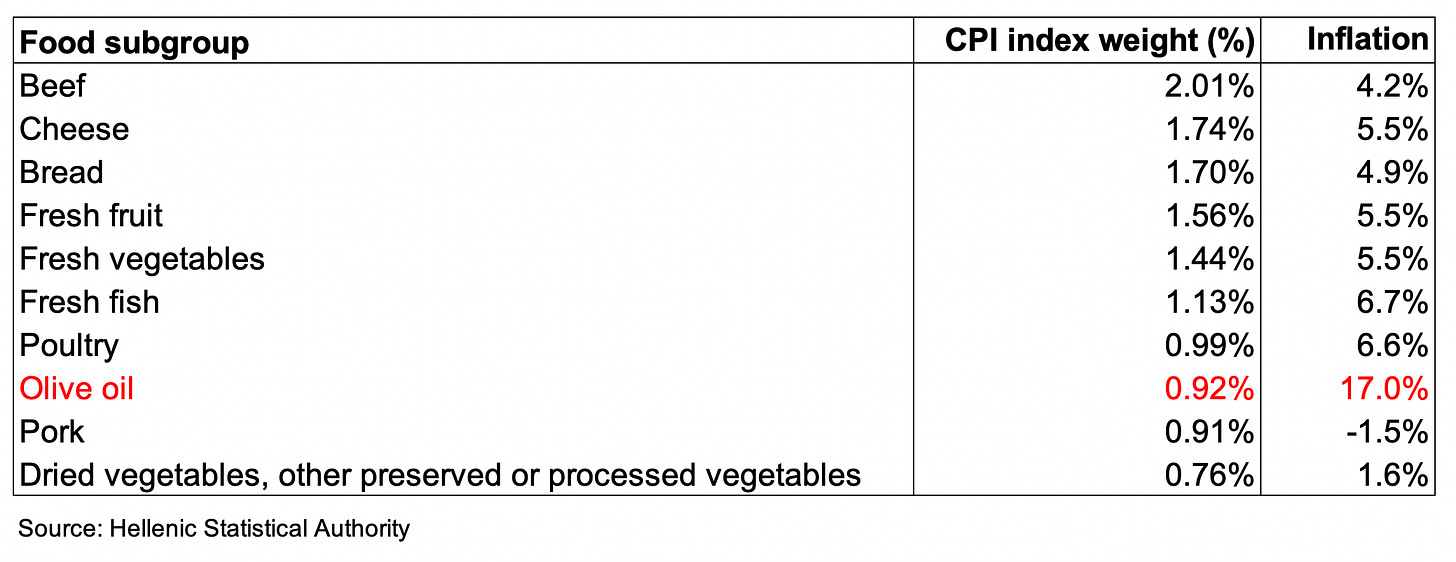

In fact, breaking the categories down further, just eight items accounted for 80 percent of December’s total headline inflation.

Natural gas prices grew by a whopping 136 percent in December compared with year earlier, but given its relative weight in the index, its inflation contribution was dwarfed by electricity. Power prices rose 45 percent, adding 1.75 percentage points to the CPI index. Motor fuels and heating oil — petroleum products downstream from crude oil — contributed a combined 1.4 percentage points to headline inflation.

Compared to these energy categories, olive oil’s contribution to CPI is comparatively small at 0.16 percentage points.2 But that’s still the sixth-biggest contribution for any one item, and the most for anything within the food category.

Food inflation was running at 4.3 percent in December, and it’s contribution to the headline inflation rate amounted to 1 percent. That’s something that’s been steadily growing in importance over the second half of the year as a hot political issue.

Food inflation is highly susceptible in increases in energy prices as that drives up input costs in a fairly low-margin business.

But my completely unsubstantiated pop psychology hypothesis is that food inflation plays outsize role in consumers’ perceptions of inflation when compared with energy costs.3 Painful as rising petrol prices may be for motorists, it seems easier to rationalise the rising cost of crude oil as being down to geopolitical factors, beyond a country like Greece’s control, than the price of olive oil.

And olive oil is an important staple for Greeks, accounting for 0.92 percent of the CPI basket — the eighth highest among food products. By contrast, for the euro area as a whole, olive oil amounts to 0.18 percent on the basket. Olive oil inflation was running at 17 percent in December.

When the Associated Press wrote up last week’s meeting of Eurogroup finance ministers, the news agency interviewed a Greek olive farmer facing higher costs to provide colour on the challenges that policy makers need to navigate.

The spike in the price of olive oil prices does need to be seen together with the price drops in 2020. But it was still 12.5 percent higher in December than it was in the same month of 2019, which is a big increase.

The two-year rate brings us back to the point noted after the CPI release — that compared with the rest of the euro area, there is more of a catch-up factor to Greek inflation following the bout of deflation in 2020 and early this year. While two-year inflation may be running high for olive oil, the headline index is just 2.7 percent higher than in December 2019. Core CPI remains 1 percent lower than two years ago.

This post provides a snapshot of what’s happening with inflation in Greece. It’s beyond its scope to recap the ongoing arguments over the transitory or persistent nature of inflation. However, while the argument for persistent inflation rests on second-order effects taking root and continuing to broaden price rises, it does remain the case that inflation up until now has been dominated by just a few items.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.

For this analysis I’m mostly using the national CPI measure rather than the EU-harmonized index of consumer prices as Elstat provides a more granular breakdown for this. National CPI is also the measure that the national press reports on, and probably a better approximation of how Greeks perceive inflation than HICP (which I usually focus on because it’s a more useful measure for comparisons with the rest of the euro area).

In fact, it’s probably the fifth-biggest contribution — and the most for any non-energy item. There’s a bit of an oranges-to-apples comparison in including “clothing and footwear”, which contributed 0.18 percentage points, since that’s a higher-level category that’s broken down less. However, Elstat does it that way in its press release, and it’s easier to just run with it.

Admittedly, this is an empirical question that may have been answered — but I didn’t dig into it much for this post.