Pandemic seals end to Greece’s ECB isolation

Once Greece was Europe's wayward distraction, but stress-free TARGET2 deficits show it catching up with the new order

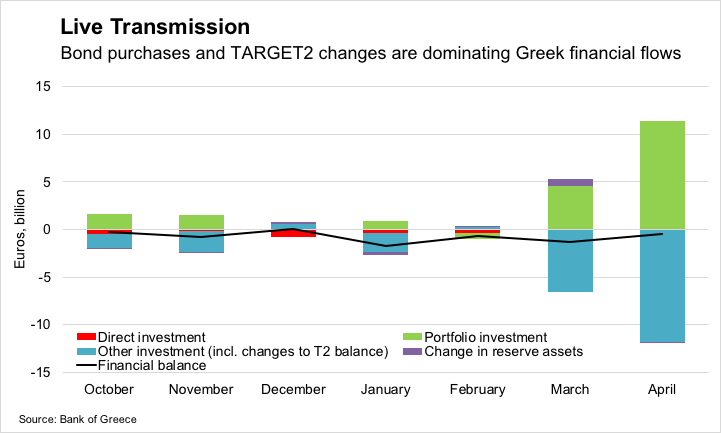

One feature of the pandemic crisis so far is that the European Central Bank’s emergency response is making its way to Greece through previously closed channels.

Specifically, the ECB’s inclusion of Greek government bonds in the Pandemic Emergency Purchase Programme, its latest round of quantitive easing, means that we can talk about problems like collapsing tourist revenue without at the same time having to worry about acute stress in the financial system.

The massive expansion of central bank balance sheets in response to the last crisis marked the start of a new order for monetary policy. But for Greece, the transmission mechanism for the new regime was never really there.

To make sense of the reasons for this, it helps to delve into some arcane details about the euro’s payment architecture, known as TARGET2.

Money flowing in or out of a country that doesn’t net out against money flowing in the opposite direction still needs to net out somewhere in the country’s balance of payments accounts. For most countries this will typically show up as a change in the central bank’s international reserves. But the ECB is the shared central bank of the euro area, so unmatched flows between its members appear as changes in the national central banks’ balances against the TARGET2 system for cross-border euro payments.

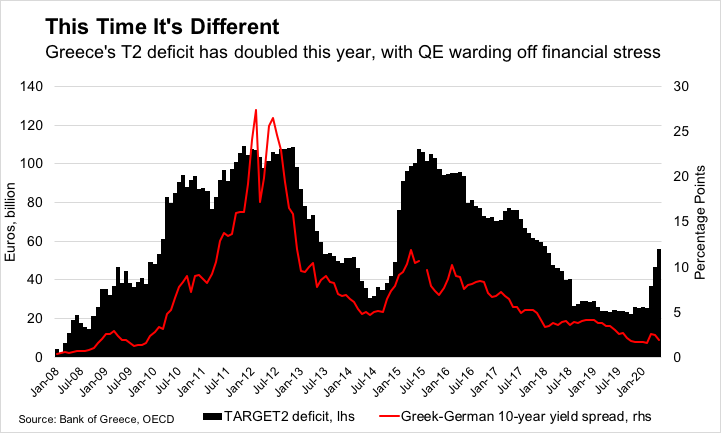

In the euro’s first decade, the flows mostly netted out so the national central banks never developed large TARGET2 positions. But when the financial crisis broke, large and unmatched flows from crisis-hit countries to safe havens like Germany turned ballooning TARGET2 imbalances into proxy indicators of financial stress.

‘Hidden bailouts’?

Since the TARGET2 claims never actually need to be settled — it helps to think of national central banks as local branches of the ECB — none of this should have mattered. But some economists in creditor countries argued that the imbalances in fact amounted to hundreds of billions of euros of hidden bailouts to indebted states. That’s on top of the hundreds of billions of euros in actual bailouts to Greece, Ireland, Portugal, Spain and Cyprus.

This formed part of the backdrop to the political battles that former ECB president Mario Draghi had to fight, notably against Germany’s Bundesbank, to get the central bank to play a stabilising role in the euro-area sovereign bond market. These fights culminated with the introduction of QE in 2015.

Greece at that point was in the throes of disastrous bailout “renegotiation” under the new Syriza government, and talk once more resurfaced about how its TARGET2 liabilities should be treated if it left the euro. From that point on, the prospect of including Greek government bonds in the list of assets eligible to be bought under QE became too politically toxic for it to be politically feasible.1

This was a point of departure between Greece and and the eurozone’s other crisis countries. In Greece the TARGET2 deficit shot up again in 2015 as a bank run left its financial system hanging on a thread under emergency central bank liquidity. But widening imbalances elsewhere were a mechanical byproduct of monetary policy operations, which calmed markets and ensured Greece stayed an isolated case.

Coronavirus crisis

But now the country is back in the ECB fold. Greek government yields initially surged during the March panic; then fell again when the ECB announced that Greek bonds would this time be eligible for its pandemic bond purchases. The yield on Greek government 10-year bonds is now just 1.15 percent, less than Italy’s.

Although the Greek crisis was usually framed as a fiscal crisis, what turned it into an economic depression was the enormous monetary contraction that took place at the same time as the government was raising taxes and cutting spending.

That’s why it was encouraging to see that bank lending to Greece’s private sector held up in May. This comes with some caveats — the fraction of additional new ECB liquidity making its way into the real economy is small, and the 4.6 percent annual increase in loans to non-financial corporations compares with 7.3 percent growth for the eurozone as a whole. Lending to small and medium enterprises contracted.

Still, it matters greatly that monetary policy isn’t compounding the economic contraction the way it did the last one. The challenges of recovering from this crisis are deep, structural and will probably take years. It also probably needs a shift in how the European Union conducts fiscal policy. But at least Greece is in the same boat as other euro-area countries.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’d like to read more posts like this, consider subscribing to the newsletter.

In fairness, having Greece’s finance minister publicly insist that the country is bankrupt did somewhat limit Draghi’s room for manoeuvre.