Macro roundup: Travel blues

Another lost tourism season doesn't bode well for Greece's current account

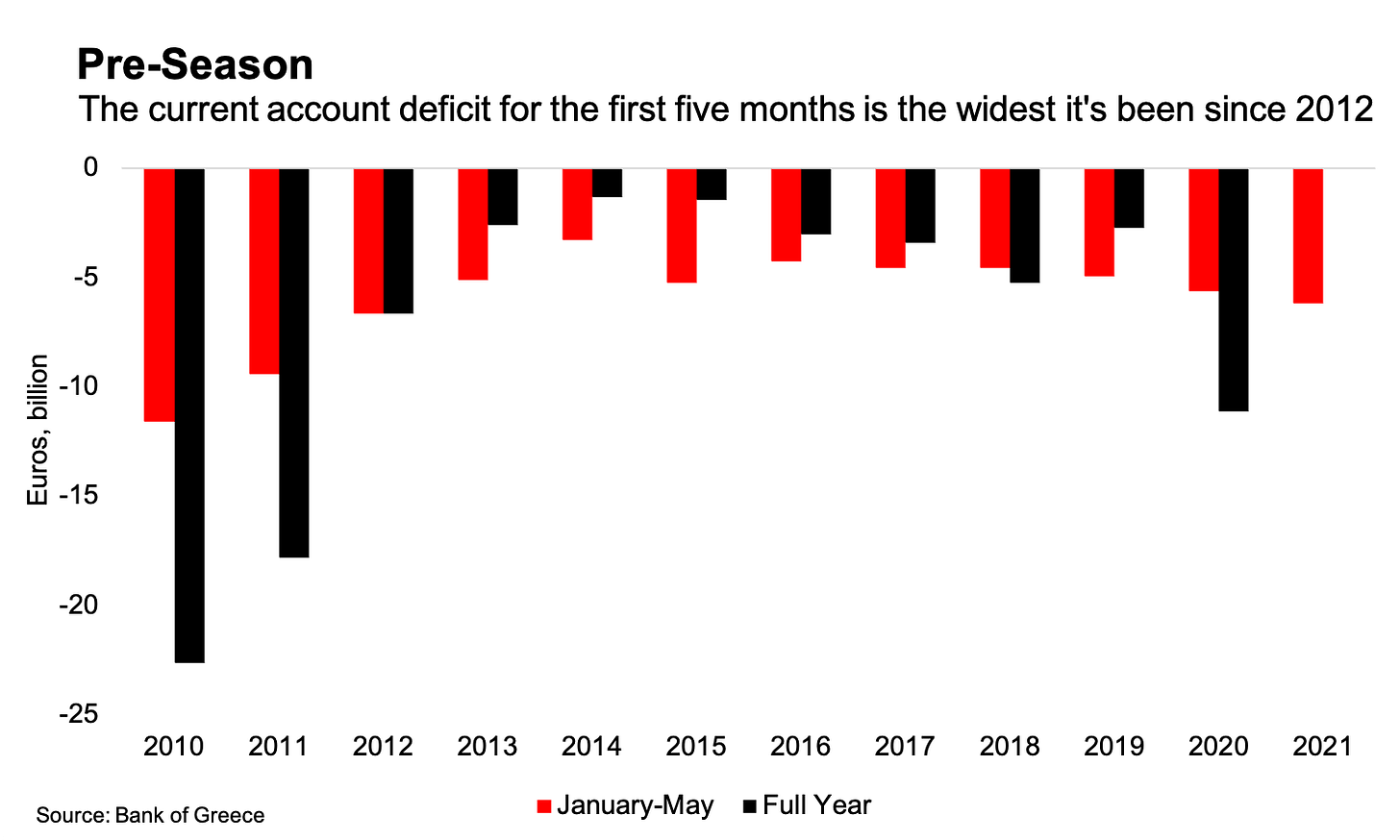

This week we got balance of payments data for May, which showed the current account deficit continuing to widen compared with last year.

The year-to-date deficit of 6.17 billion euros is the widest it’s been since 2012. In truth, that’s bigger, but not substantially out of line with where it usually is at this time of year. Imports have been driving the increase, but exports are going up too. But these five months were just a warm up for the critical time period for the current account, which is happening now as we head into the peak of summer.

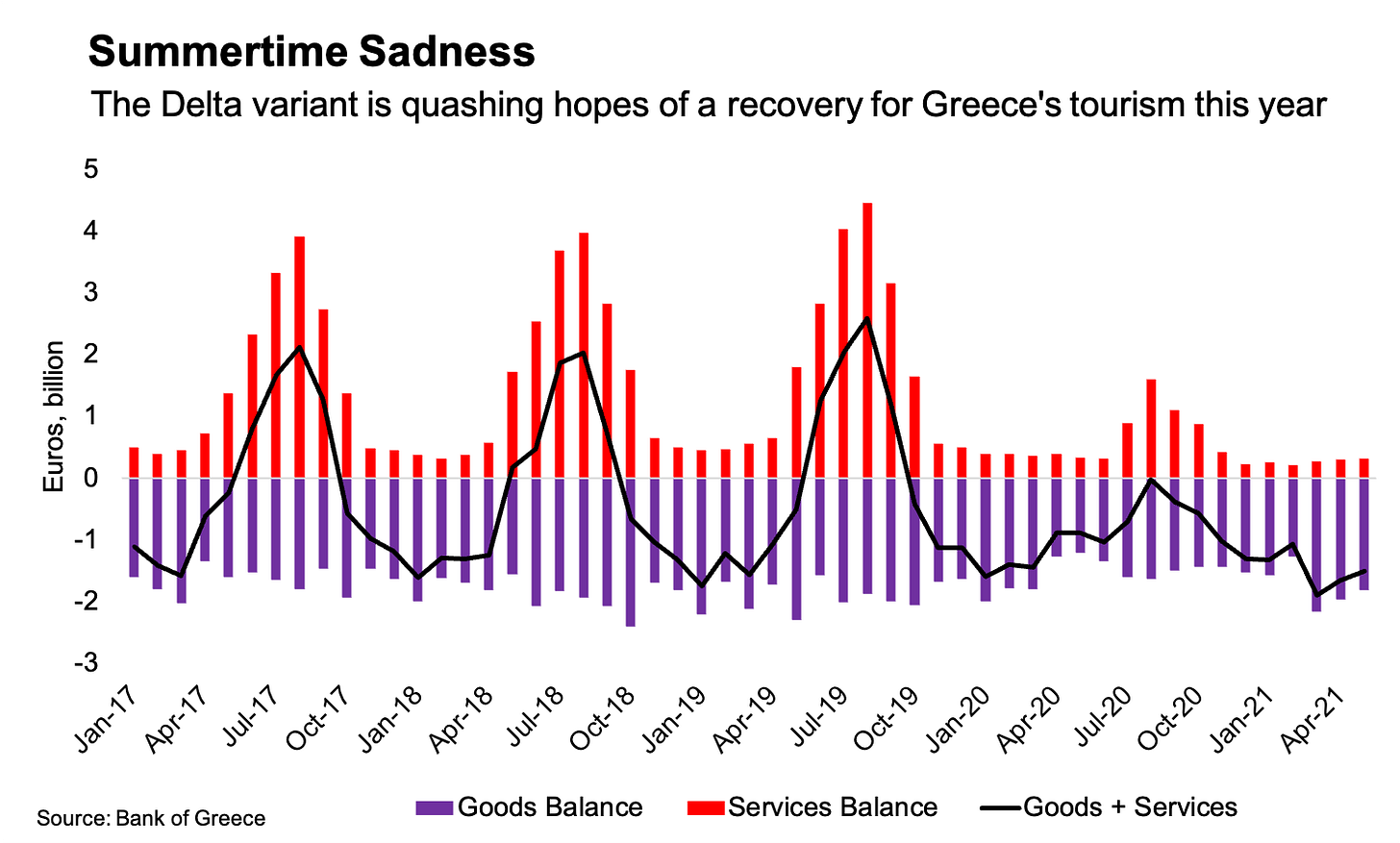

Greece’s current account is highly seasonal due to the the importance of sun-and-sand tourism. Normally, the goods balance remains in deficit at a fairly constant rate, while the services surplus does a year’s worth of heavy lifting from June to September.

That didn’t happen last year, and now the portents aren’t great for this year either. The latest surge in Covid cases as a result of the Delta variant is quashing any remaining hopes of a strong rebound in the sector.

When the tourism season officially kicked off in May, amid much fanfare, the hope was that the UK would remove Greece from its “amber list” of countries, easing travel from the country’s second-biggest market. Two months on, and Greece has been added to the amber list of Germany — the biggest market.

Data for May showed that travel receipts for the month came to 168 million euros, a 286 percent increase on last year. That’s still almost 90 percent less than May 2019, when receipts came to 1.57 billion euros.

Last year’s current account deficit came to about 7 percent of gross domestic product, and most forecasts are for it to stay around about that level again this year. Any hopes of a positive surprise are fading along with the rise in new Covid cases.

Calm waters

The good news is that economic stress still isn’t translating into financial stress.

At this point of the pandemic, this observation is pretty old hat — and that’s the main reason why we haven’t taken a look at the financial account for a while. Still, it’s a good idea to check in every once in a while, even if only to have a reference point we can look back on in the future.

The TARGET 2 deficit has been steadily rising for much of the year — increasing by 11.9 billion euros in the fist half of the year — but at nothing like the levels seen at the start of the pandemic.

Meanwhile, ECB funding for the banks — through targeted longer-term refinancing operations, which incentivise lending to the real economy by effectively paying banks to borrow from the central bank — has also been pretty stable, increasing by just over 10 billion euros in the past year.

Programming note: Grecology is off on vacation from Monday and will be away for a few weeks. The next macro roundup will come out on Aug. 20.

Next week’s key data

Monday, July 26:

Six-month central government budget execution, final data (Finance Ministry)

Tuesday, July 27:

June bank deposits and lending (Bank of Greece)

Thursday, July 29:

July economic sentiment (European Commission)

Friday, July 30:

May retail sales (Elstat)

Elsewhere on the web

Christian Odendahl argues that Europe shouldn’t worry about inflation — pointing out that all five ingredients needed to get it sustainably above 5 percent are missing.

Sticking with inflation, Daniel Neilson illustrates a theory of prices using cars and chips.

The IMF released its Article IV consultation staff report on Greece. The accompanying selected issues paper looks at the country’s investment gap and at corporate vulnerabilities in the wake of the pandemic.

Malcolm Brabant reports for PBS on boat pushback from Greece’s Coast Guard, leaving migrants adrift in the Aegean.

A couple of items from the Bruegel think tank breaking down RRF plans across EU countries: the first is for green spending, the second for digital expenditure.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.