Macro roundup: Rising tide

Greek household balance sheets are emerging healthier from the crisis

Disposable income soared in the second quarter, but Greek households saved less as consumption jumped even more.

This is in line with what we’re seeing with the rest of the world as a result of economies opening up again, and is a reversal of what we saw last year. Then, disposable income dropped, but with consumption also collapsing, the household savings rate turned positive for consecutive quarters for the first time since 2011.

There’s a heavy base effect in the latest readings, released by Elstat as part of the sectoral non-financial accounts. The 15.3 percent increase in consumption in the second quarter compared with a year earlier — during the first lockdown — still represents catch-up spending. The level is 0.8 percent below what it was in the same quarter of 2019.

Disposable income rose 7 percent from a year earlier. But the second quarter of 2020 was the only one in which it dropped, as social transfers from the government quickly kicked in afterwards.

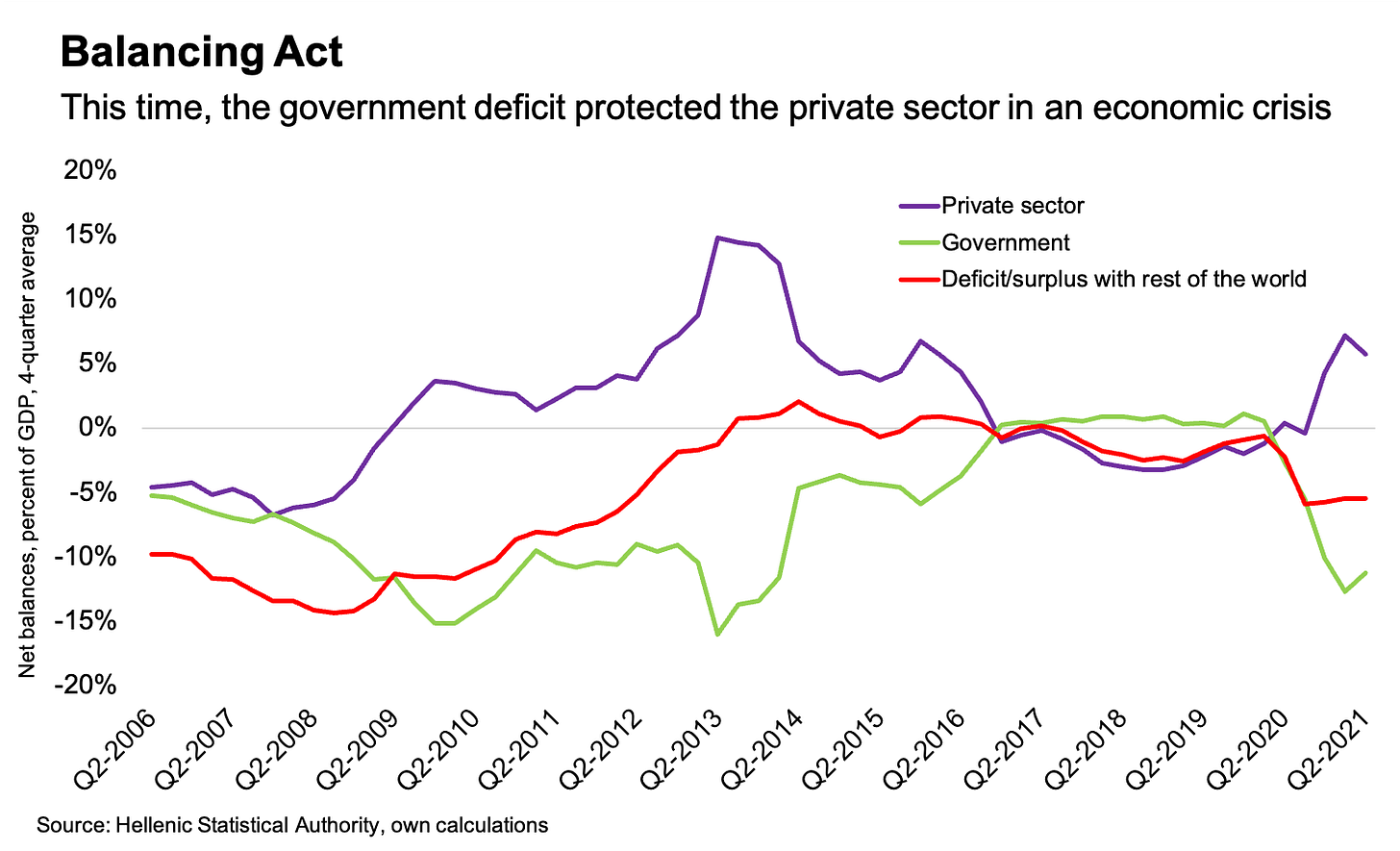

As we’re seeing the domestic private sector start to save less and spend more, we’re also seeing government finances gradually start to improve. The contrast couldn't be more marked with a decade ago, when the government had to try to reign in its deficit — unsuccessfully at first, due to the collapse in economic activity — at the same time as a credit crunch was driving private sector deleveraging.

Loan security

Meanwhile, the Bank of Greece released flow of funds data for the second quarter today, which showed the private sector’s financial net worth deteriorating slightly.

I’d been waiting for this release since last month, when I saw that the non-financial private sector’s net assets were just 3.9 billion euros short of turning positive after six quarters of steady improvement. However, today’s data showed the net liability increased to 16.2 billion euros from a revised 6.6 billion euros in the first quarter.

The deterioration is entirely down to the business sector, with households seeing their aggregate net financial assets increase by 500 million euros to 186.1 billion euros. In fact, we can further say that the deterioration was down to valuation changes in the liabilities of non-financial corporations, which actually saw positive flows of 1.6 billion euros in the quarter.

Digging deeper into the numbers suggests the main reason for the change might somehow be related to the banks’ securitisation of non-performing loans.

The stock of corporate liabilities in the form of long-term loans held by the “rest of the world” increased by 10.5 billion euros in the second quarter, with a corresponding flow amounting to just 2.6 billion euros. Meanwhile, Greek financial corporations saw their stock of long-term loans to the corporate sector drop by 2.8 billion euros.

I can’t give an explanation for the accounting mechanics behind how these valuation changes relate to the securitizations1. However, in the series data going back over 20 years, there hasn’t ever been such a big jump in the stock of corporate loan liabilities to the rest of the world — and nowhere near such a big mismatch between the change in stocks and the flow.

Other data

Credit growth to the private sector continues to slow, dipping to 0.7 percent in September from 0.8 percent the month before. However, net new lending in the month was 537 million euros, following negative flows in July and August.

Private sector deposits at Greek banks rose another 443 million euros in September to reach 173.7 billion euros.

The euro-area inflation rate increased to 4.1 percent this month from 3.4 percent in September. Elstat doesn’t publish the Greek rate until Nov. 10, and the estimate for Greece published in the Eurostat release tends to be off by a few decimals. But for what it’s worth, that estimate sees the Greek rate jumping to 3 percent in October from 1.9 percent.

Retail sales increased 8.8 percent in August from a year earlier. Volume increased 6.6 percent.

Greek economic sentiment improved a little bit in October, according to the European Commission. However, consumer confidence dipped for a fifth straight month and is now at the same level it was at in December.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key data

Monday, Nov. 1:

October purchasing managers index (IHS Markit)

Thursday, Nov. 4:

September commercial transactions (Elstat)

Elsewhere on the web

Chris Marsh wrote an excellent thread on twitter in response to last week’s newsletter. In it, he points out that the TARGET2 deficit is considerably smaller when you strip out the effects of the Bank of Greece’s QE purchases of bonds from the multi-lateral EU agencies.

Here’s one reason given for why Greek banks aren’t lending more to SMEs.

Get ready to pay 11 percent more for souvlaki.

That means you, Andy Garcia! Stelios Bouras reports on boom in Hollywood movies being filmed in Greece.

Duncan Weldon on the stories we tell about inflation.

If you don’t spend much time on economics Twitter, you will have missed the debate going on there last week about whether economists need to read the foundational texts in the field. I like Brian Romanchuk’s take on comparisons with mathematics.

That piece pairs well with Zachary Carter’s post on Milton Friedman and the latest Nobel Prize winner (which pre-dates last week’s Twitter debate, but nicely demonstrates the benefits of familiarity with the Classics).

Finally, here’s another great tweet thread, by Cory Doctorow, on the academic publishing racket:

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.

Though intuitively, a simplistic explanation makes sense: presumably buyers of these securities will value them higher than the banks selling them, otherwise it wouldn’t make sense to buy them.