Macro roundup: Picky Lenders

New bank lending to SMEs has been modest when there's no government support

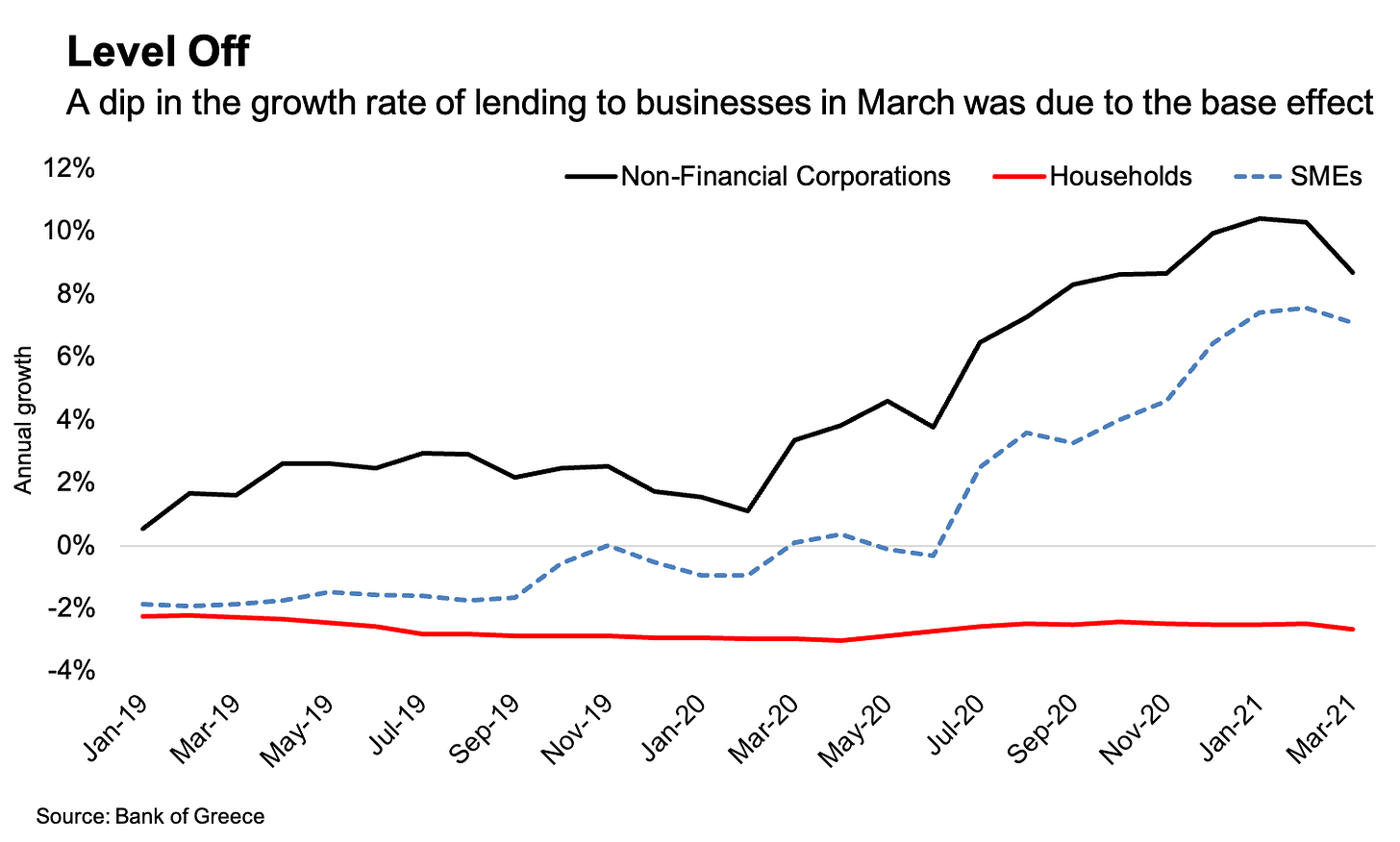

Just before the Easter break, we got March figures for bank lending to Greece’s private sector, and its worth catching up again with these figures.

The numbers show a drop-off in the annual rate of credit expansion to 2.9 percent from 3.7 percent the month before, but that’s mostly down to the base effect rather than a slowdown in lending. The equivalent month of 2020 was when the first lockdown started — and with it came a surge in working capital borrowing for non-financial corporations. The net monthly flow of new credit was higher in March this year than it was the month before.

Broken down, credit growth continues to come entirely towards businesses, with lending to households decreasing 2.7 percent — roughly the rate at which it’s been steadily contracting for about a decade now. Credit to non-financial corporations grew at an annual rate of 8.7 percent, down from 10.3 percent in February.

On the face of it, the growth in lending to small and medium-sized enterprises is also progressing at a fair pace, at 7.1 percent.

But looking at a monthly chart of net of lending to SMEs, it becomes clear that the overwhelming bulk of new lending to them took place in the first month of the lockdown, then even more so in July and December of last year. The latter two dates correspond to application deadlines for rounds of government SME liquidity support.

What this pattern shows is that there’s only limited bank appetite to lend to SMEs without the comfort blanket of a government guarantee. March’s net flow of 224 million euros was the most since 2019 outside the three peak months, but it was still substantially less those.

By contrast, the pattern of lending to non-SME businesses has been far more even.

There’s a separate conversation to be had about how much debt Greece’s private sector in general, and SMEs in particular, can sustainably absorb. Relatedly, government policy has been shifting away from subsidising working capital loans towards forms of support that won’t need to be repaid.

Nevertheless, the central bank’s most recent lending survey suggests there’s no lack of demand:

“The overall demand for loans to NFCs remained almost unchanged, even though the demand for loans to small to medium sized enterprises increased somewhat due to the increased financing needs for inventories and working capital.”

Other data

Private sector deposits continued their rise in March, increasing by another 1.66 billion euros. With the latest increase, the domestic banking system has finally recovered all the deposits that were lost during the 2014/15 bank run.

Explaining why household deposits are on such an upward trend — disposable income rose 0.8 percent in the fourth quarter of 2020, while household consumption fell 8.9 percent.

The manufacturing PMI index increased to 54.4 in April, signalling the biggest improvement in operating conditions since the start of the pandemic. This was largely due to a pickup in domestic demand, with new export sales continuing to decrease, according to IHS Markit.

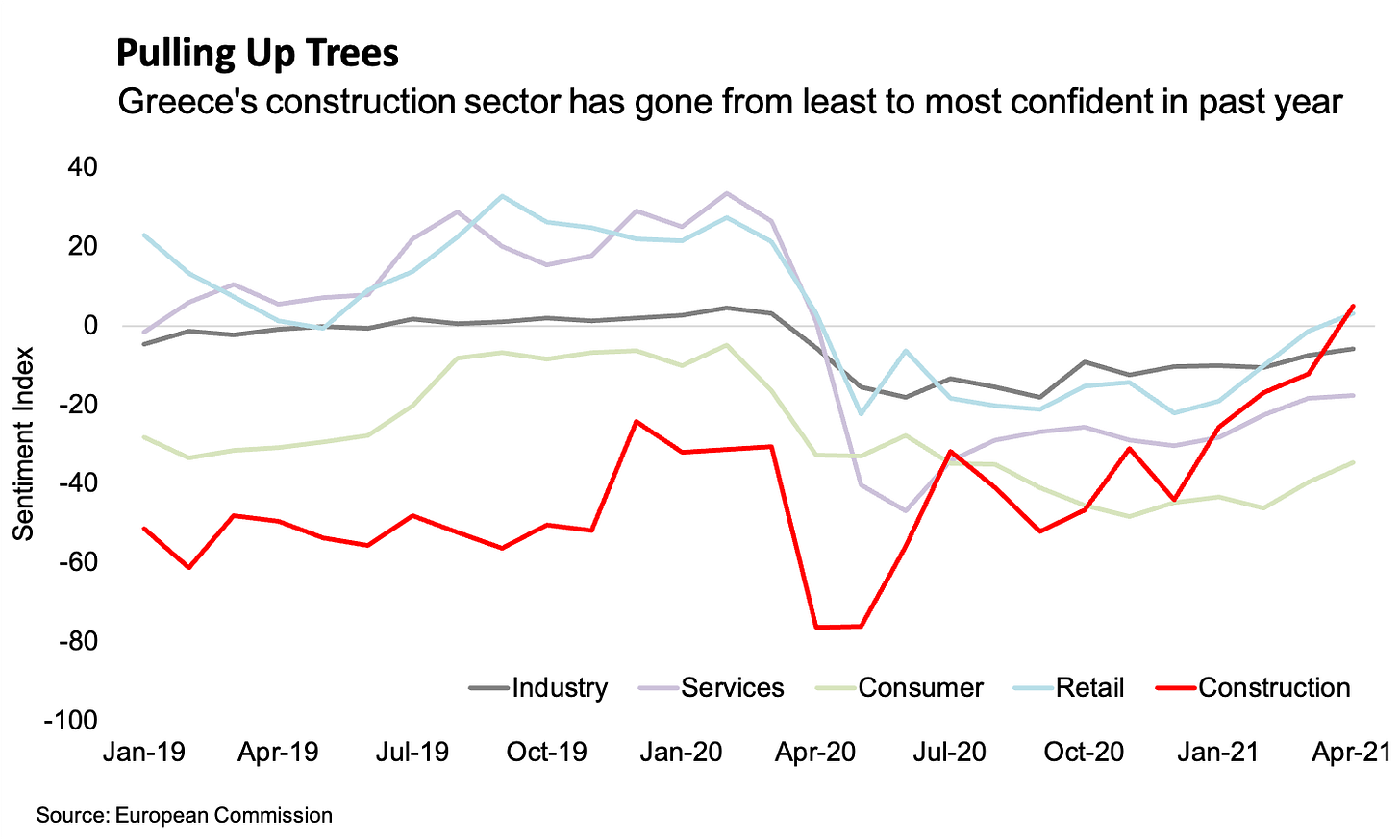

Finally, the European Commission’s economic sentiment indicator also improved in April. And since we’ve been focussing so much on construction lately, check out the turnaround in the construction sector, below. Confidence in construction is now at its highest level since 2006.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key data

Monday, May 10:

March industrial production (Elstat)

Wednesday, May 12:

April consumer price index (Elstat)

February building activity survey (Elstat)

Thursday, May 13:

February unemployment (Elstat)

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.