Macro roundup: Lending growth stalls

The wave of Greek bank lending to the private sector has petered out this year

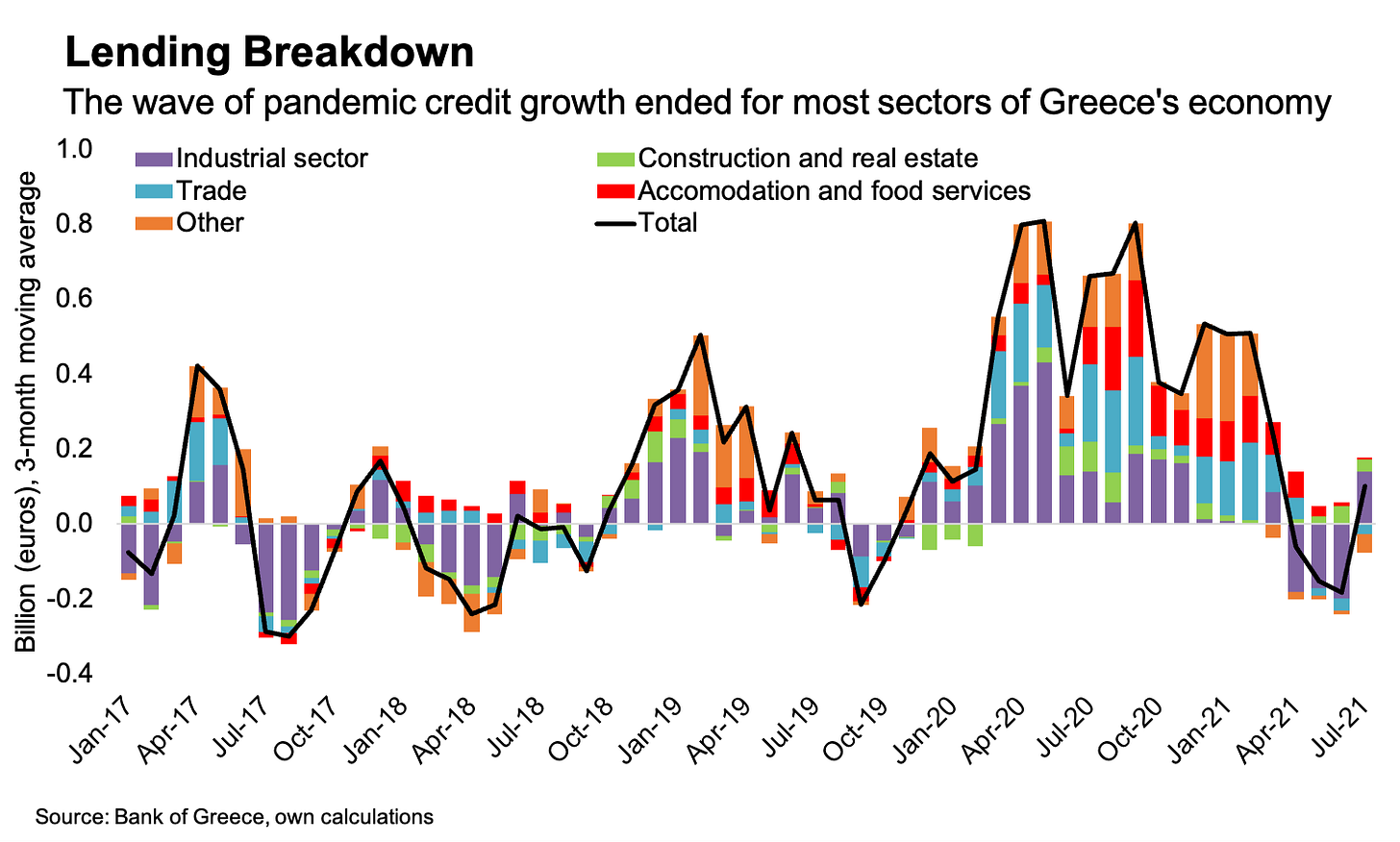

The lending figures for Greece’s banking sector in July confirm the trend of a loss of momentum in credit expansion to the private sector.

Annual credit growth to the private sector slowed to 1.2 percent from 2.3 percent in June, according to the Bank of Greece data that came out yesterday. For non-financial corporations, the rate dropped to 4.1 percent from 6.2 percent — having previously reached as high as 10.4 percent in January. Lending to households never really expanded during the pandemic to begin with.

Last year, net new lending to non-financial corporations amounted to 6.7 billion euros. So far this year, net new lending amounts to just 106 million euros — and that’s mainly due to a flurry of corporate bond issuance. Stripping out securities, there’s been a net reduction in loans to businesses of 417 million euros so far this year.

The one silver lining is that while loans of short and medium term duration have been contracting so far in 2021, loans with a duration greater than five years — the kind of long-term loans that finance investment projects — have expanded by 923 million euros so far this year. But that’s still less than half the amount it was in the first seven months of last year. The total for 2020 came to 3.4 billion euros.

To his credit, this is a drum that Bank of Greece governor Yannis Stournaras has been beating since winter, complaining that not enough of the almost 40 billion-euro expansion in liquidity for Greek banks was making it to the real economy. Back then, the credit expansion was at least still on an upward trajectory.

It may be the case that with the lifting of lockdown restrictions, and the economy bouncing back in the second quarter, companies are now more able to generate their own liquidity and are less reliant on banks for their working capital.

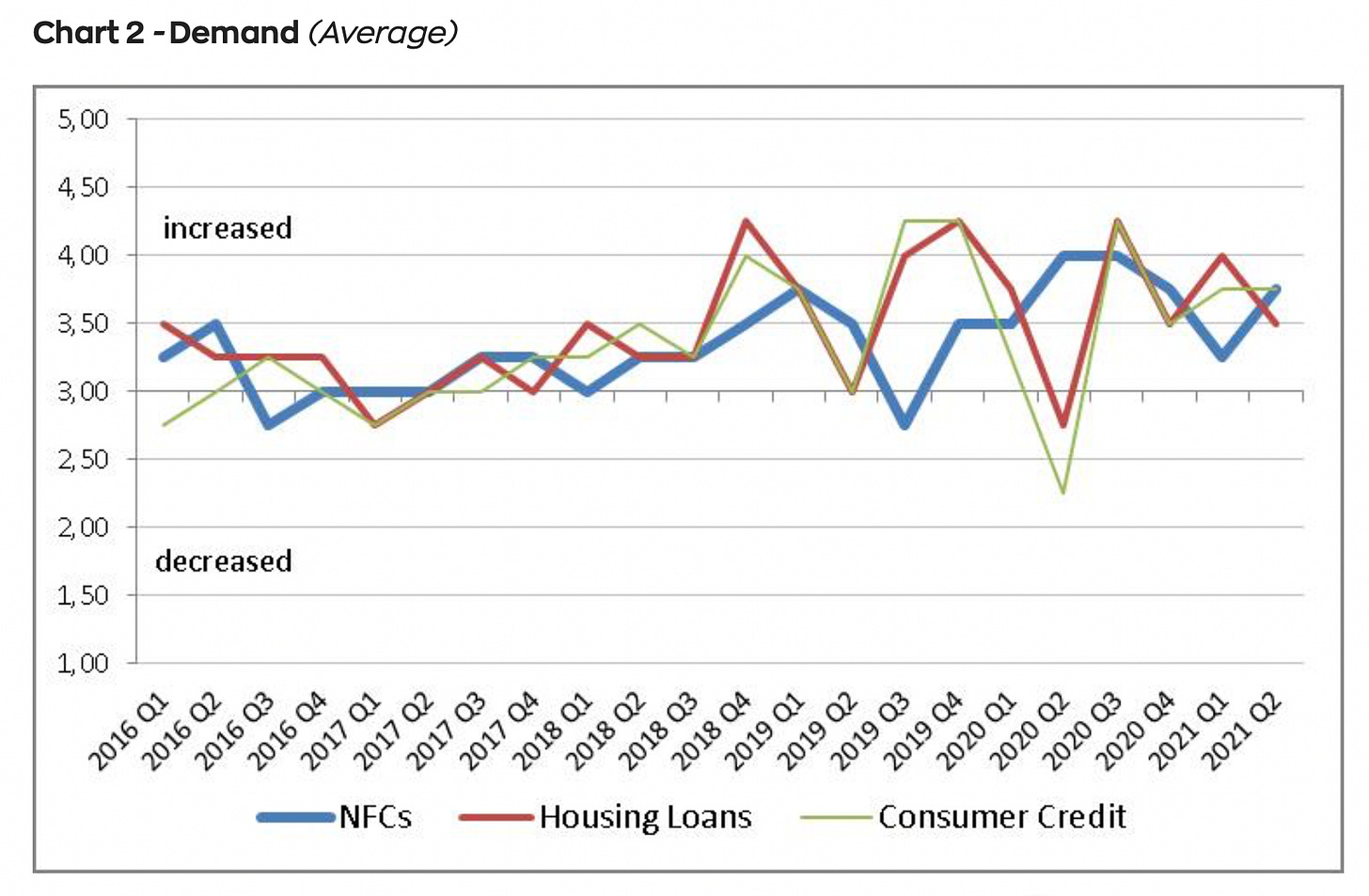

Nevertheless, the bank lending survey produced by the Bank of Greece suggests there was no let up in demand for loans in the second quarter.

In any case, a central axis on which the government is spinning its national economic recovery plan — and on which the banks themselves are marketing capital increases to investors — is that it will be able to harness commercial bank loans, on top of 31 billion euros of European Union funds, to help mobilise a total of almost 58 billion euros in investment.

That goal is challenging. Recent months’ lending data shows that it would take a second wave of credit expansion before it could be met.

Other data

Private sector deposits continued their upward rise in July, increasing another 1.84 billion euros to 171.6 billion euro. That’s the highest since December 2011.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key data

Monday, Aug. 30:

August economic sentiment (European Commission)

Tuesday, Aug. 31:

June retail sales (Elstat)

Wednesday, Sept. 1:

August purchasing managers’ index (IHS Markit)

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.