Macro roundup: Inflation? What inflation?

Consumer prices are still falling in Greece

Since “inflation” is the buzz word in global economics right now, this week’s roundup has to lead on the consumer price data that came out on Wednesday.

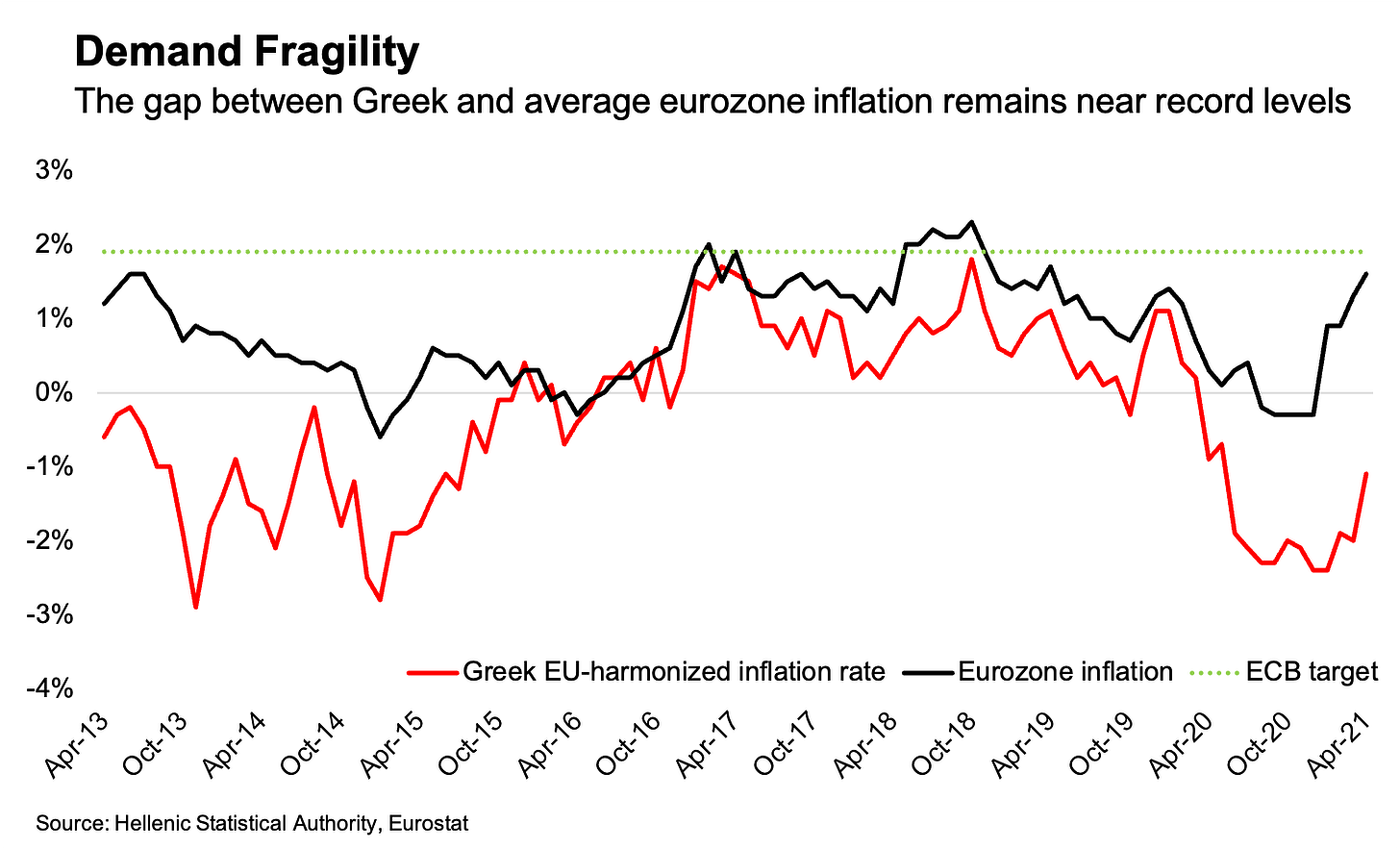

Well, deflation remains the name of the game in Greece, as the EU-harmonised consumer price index fell 1.1 percent in April from a year earlier, its 13th straight month of decline. That’s a far cry from the 1.6 percent increase for the euro area as a whole, never mind the 4.2 percent reading seen in the US this week.

It’s widely noted that the inflation seen in these bigger economies are the result of supply-chain bottlenecks as countries emerge from lockdowns — as well base effects from last year’s collapse in energy prices.1

There has been evidence of these pressures in Greece too. Markit has been mentioning it in its monthly manufacturing PMI reports, and we noted it in the construction sector a few weeks ago. The base effects are particularly visible in Elstat’s release today of the import price index industry for March. This increased 24.6 percent, led by a 131 percent jump in crude oil and natural gas.

The fact that these pressures on producers haven’t been passed on to consumers — as they have elsewhere — shows how fresh the scars from Greece’s previous crisis are, and how fragile the economy remains.

Other data

Deflation or not, economic forecasters are lifting some of their winter gloom about the country’s prospects. The European Commission released its spring forecasts this week, and it now expects Greece’s gross domestic product to grow 4.1 percent this year, revised from 3.5 percent. In 2022, the Commission sees GDP growing 6 percent, instead of its previous 5 percent forecast.

Industrial production increased 5.5 percent in March from the same month of 2020. This was led by a 17.6 increase in the electricity supply index, though manufacturing also rose 3.4 percent.

Building activity, as measured by the number of permits issued, fell 3.2 percent in February from a year earlier, though surface area increased 16.4 percent and volume was up 25.6 percent.

Car sales surged 355 percent in April compared with a year earlier. Vroom! But they’re still 12 percent lower than in the same month of 2019. Let the nonsense numbers begin.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key data

Monday, May 17:

January-April state budget execution (Finance Ministry)

January unemployment (Elstat, publication of a postponed release)

Tuesday, May 18:

First quarter residential property price index (Bank of Greece)

March business revenue (Elstat)

Thursday, May 20:

March balance of payments (Bank of Greece)

Elsewhere on the web

Megan Greene says that Joe Biden’s rescue plan could herald a revolution in economic thinking.

Eleni Chrepa writes about the Hellinikon development at Bloomberg CityLab.

Simon Wren-Lewis argues that the euro area’s fiscal rules should be based on macroeconomic stabilisation, not debt stabilisation.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.

I’d like to think that this is a well-understood point, but it’s been interesting to see long-cowed Friedmanites triumphantly emerging to proclaim that inflation is always and everywhere a monetary phenomenon. There used to be a gag that Marxian economists predicted 11 of the last five recession. That joke could do with an update for monetarists predicting inflation’s return.