Macro roundup: Inflation rips

Greek price rises overtook euro-area average in January for the first time since 2017

The latest Greek inflation data makes for uncomfortable reading, with the EU-harmonized index of consumer prices rising 5.5 percent in January from a year earlier.

Since the index for the euro area as a whole increased 5.1 percent, the rate of inflation was higher in Greece than for the rest of the currency bloc for the first time since 2017. That’s largely due to the base effect that’s still strong in the Greek data. Whereas in January 2021 prices in the eurozone had begun their upward tear, in Greece they dropped 2.4 percent from a year earlier.

Comparing prices in January with the same month of 2019, the Greek index has risen just 3 percent, whereas for the euro area as a whole it is up 6.1 percent.

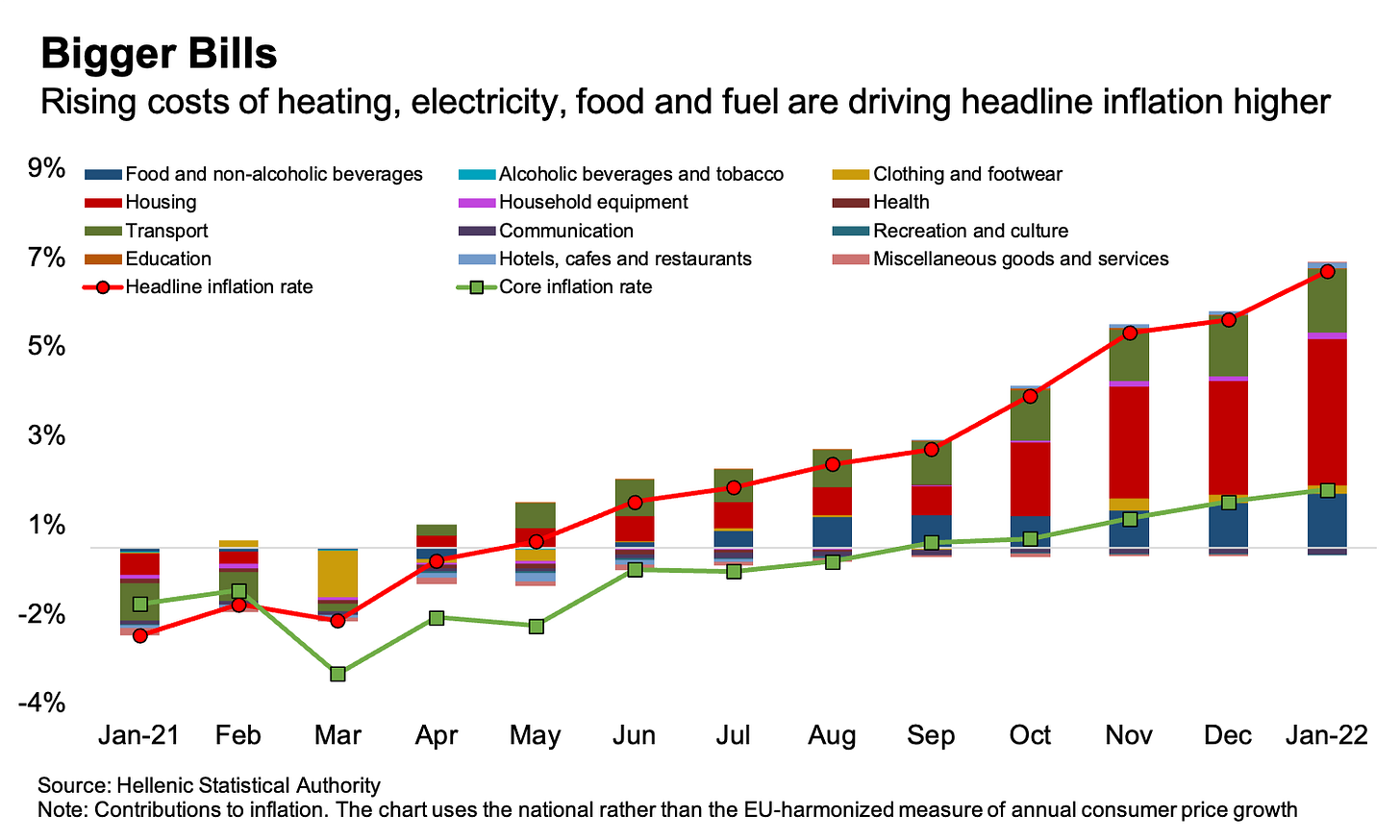

But price rises are still painful, and it gets worse when we switch to the national measure of inflation that we used for a deeper dive a few weeks ago. On this measure, consumer prices rose 6.2 percent in January, compared with a rate of 5.1 percent in December.

Most of the increase in the index is still dominated by food and energy costs — especially the former. Core inflation, which strips out these more volatile elements, increased to 1.3 percent from 1 percent in December.

Other data

The unemployment rate in December dropped to 12.8 percent from 13.4 percent the month before. The rate is the lowest since 2010, and this probably should be getting more than a bullet soon.

The central government posted a primary budget surplus of 17 million euros in January, compared with a target for a 1.1 billion-euro deficit. That’s because 1.3 billion euros in payments for purchase of fixed assets (weapons spending) slated for January hasn’t occurred yet, but will do so later. Net revenues amounted to 3.86 billion euros, compared with a target of 4.47 billion euros.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key releases

Monday, Feb. 21:

December balance of payments (Bank of Greece)

Friday, Feb. 25:

January bank lending and deposits (Bank of Greece)

February economic sentiment (European Commission)

January central government budget execution, final figures (Finance Ministry)

Elsewhere on the web

Costas Kantouris and Derek Gatopoulos report for the AP on farmers’ protests against the surging energy prices.

The latest out of Germany on the debate over changing eurozone fiscal rules:

Identical European Commission assessments that countries’ recovery plan cost justifications raise questions about how well the money will be spent.

Charlotte Higgins in the Guardian on why Britain is resisting returning the Parthenon sculptures.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.