Macro roundup: Greece's hyperinflation

And now for something completely different: fragments of economic history

This has been a quiet week for Greek economic data releases. I’m not gonna lie, I didn’t feel we needed a deep dive into April’s building permits, or the January-to-June state budget execution. So instead, we will enjoy some snippets of economic history.

Specifically, I’d like to re-share this table from Adam Tooze’s recent post on China’s 1940s hyperinflation (the table is originally from Chang Kia-Ngau’s 1958 work), which compares it with Germany, Greece and Hungary.

Anyone at all familiar with modern Greek history knows that this was a time of starvation and extraordinary economic hardship. Oxfam began in 1942 as an attempt to bring famine relief to Nazi-occupied Greece, while the post-war Truman Doctrine and Marshall Plan also had their genesis in Greek aid.

Nevertheless, it’s still shocking to see Greece and Germany side-by-side in the table, in black and white, with numbers showing that Greek inflation between 1939 and 1953 was almost 20 times higher than Germany’s between 1914 and 1923.

It’s a shock because of the familiar narrative that German scars from the Weimar hyperinflation led to the ultra-hard-money doctrine of the Bundesbank — which was then passed on to the European Central Bank when the euro was founded. But Germany’s experience with hyperinflation was not as singular as its persistence in public consciousness suggests.

Tooze’s post also inspired me to trawl through the Pathe News YouTube channel to find archive newsreel footage of the period, like he uses for Shanghai.

The above, 50-second newsreel accompanies the signing of $400 million of loans for Greece and Turkey in 1947, the first fruit of the Truman Doctrine. The clip presents a slice of life in an Athens that seems to be recovering from the worst. “For those with money, life is easy,” the narrator signs off.

What’s even more fascinating is a longer, 4:39-minute soundless video, which shows additional, unused footage. The whole thing is fantastic and worth watching to get a flavour of postwar Athens. But from the 3:30 onwards it shows a commotion outside the Bank of Greece. At one point this involves what looks to me like the British Army spraying people with water cannon (I didn’t know these were even in use then).

I don’t know what’s happening to cause the scene outside the central bank (if anyone does, I’d love to hear). If I had to guess, I’d say that people in the crowd are trying to exchange drachma notes for gold sovereigns (on 4:14, you can see someone holding up what could be a bundle of drachmas).

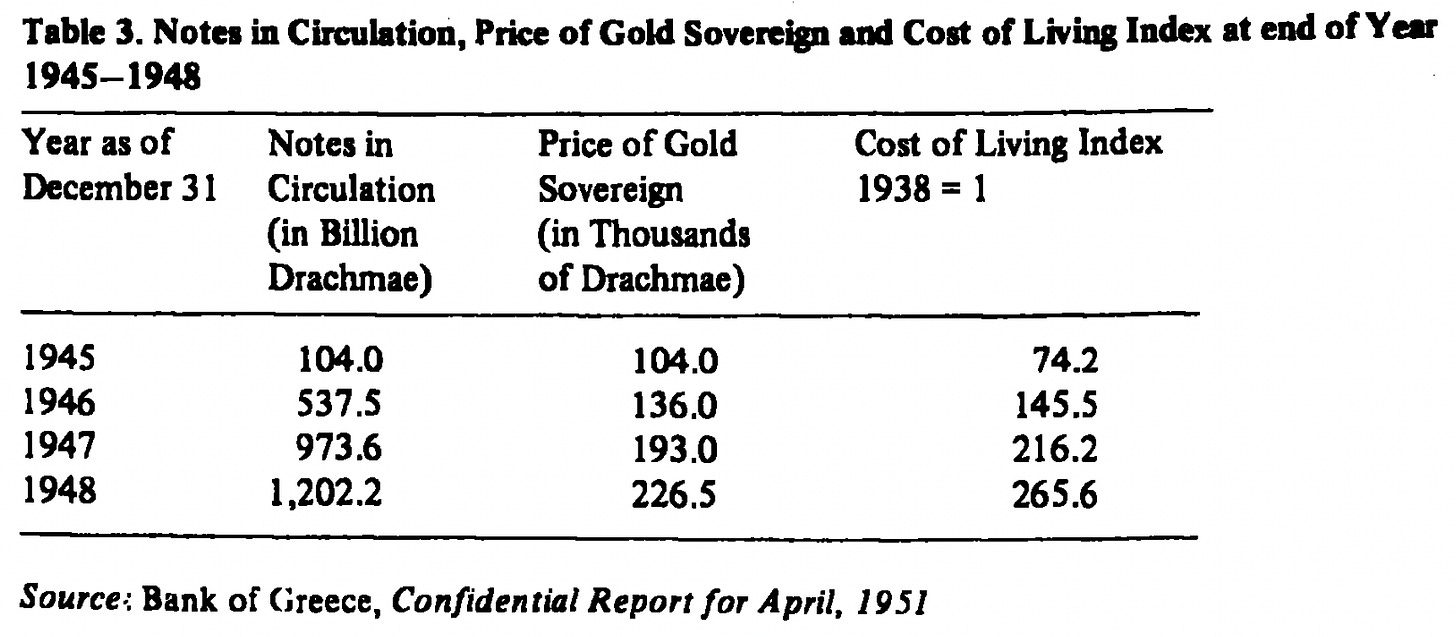

According to this 1977 paper by Alexander Kondonassis, the Bank of Greece was active in the gold sovereign market after 1946 as it tried to halt the rise in the drachma price of gold.1 This policy was not too successful, according to Kondonassis:

When I was a child, the gold sovereigns and trinkets that were birth gifts from my grandparents to me and my sisters were beautiful, sparkly objects that were nice to look at. But for my grandparents, they were practical: a safe store of value.2

This week’s data

The Finance Ministry released the central government’s budget execution figures for the first half of the year, which showed the primary deficit was 9.09 billion euros, compared with 6.1 billion euros in the first six months of 2020. The target set out in the 2021 budget was for a deficit of 8.18 billion euros.

Building activity, as measured by the number of permits issued, increased 125 percent in April compared with the same month of 2020. Last year’s reference point was at the height of the first lockdown, so there’s a strong base effect, though construction has clearly continued to do well during the pandemic. On a rolling 12-month basis, permits increased 13.4 percent compared with the 12 months from May 2019 to April 2020, even though the recovery in construction was already well underway when Covid struck.

Next week’s key data

Tuesday, July 20:

Q2 bank lending survey (Bank of Greece)

Wednesday, July 21:

May balance of payments (Bank of Greece)

Elsewhere on the web

Turning now to more run-of-the-mill inflation, a reader alerted me to a post by Daniel Gros and Farzaneh Shamsfakhr on how EU-harmonized inflation rates continue to underestimate the cost of housing.

Martin Sandbu writes at the FT that the European school of central banking is no more.

The IMF has published a paper and accompanying blog post on the resilience of European private sector balance sheets. Key takeaways: not all private sector balance sheets were equally resilient, and governments shouldn’t do anything stupid as they start drawing back support.

If you thought Cyprus’s golden passport scheme was dodgy, check out Vanuatu’s.

Bonus video

After trawling the Pathe footage, I couldn’t resist also sharing this footage of Thessaloniki — a city close to my heart — before the great blaze of 1917.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.

A.J. Kondonassis (1977) The Greek inflation and the Flight from the Drachma, 1940–1948, Economy and History, 20:1, 41-49.

For my grandparents, portability was also an important factor. But the trove was burgled in the 1990s. So there really are no risk-free assets.