Macro roundup: Extra homework

A higher proportion of Greeks are working from home than during the first lockdown

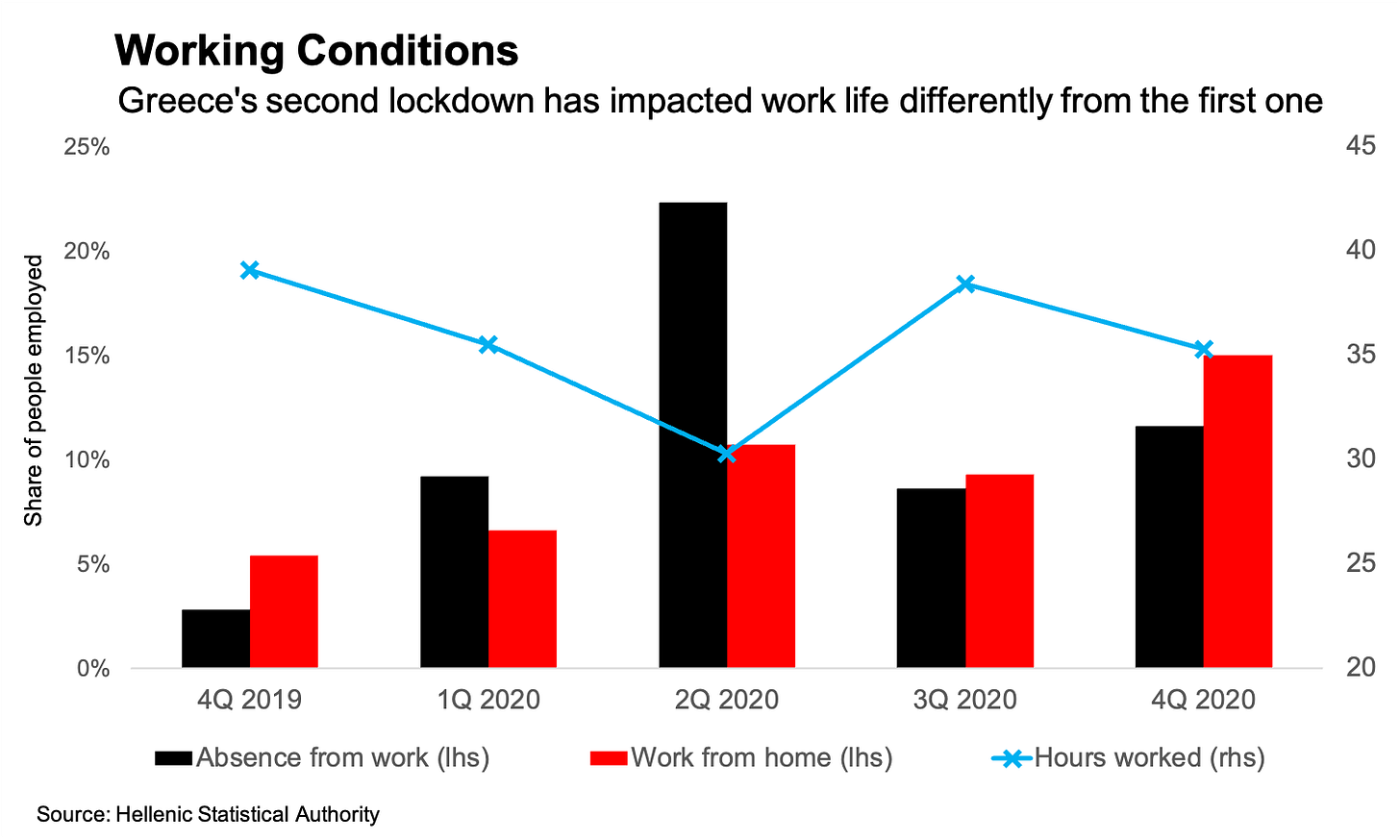

Life under the second lockdown in Greece has meant working longer hours than during the first, as people become accustomed to tracksuit bottoms and Zoom calls.

That’s a conclusion that can be drawn from Elstat’s labour force survey this week, which shows that, when comparing the fourth quarter of last year with the second, there was a sharp drop in absenteeism, but an increase in people working from home.

During the first lockdown, the average numbers of hours worked by employees dropped to 30 in the second quarter, from 39 in the fourth quarter of 2019. After recovering to 38 hours in the third quarter of 2020, the number of hours work only dipped to 35 in the last three months of the year.

The comparison isn’t perfect, since Greece didn’t go back into lockdown until midway through the fourth quarter, in November. However, since the government eased the first lockdown in May and June, things probably just about balance out.

Other data

Unemployment dropped to 16.2 percent in the fourth quarter, unchanged from the third. The quarterly time series isn’t seasonally adjusted, so the headline rate is less useful than the monthly series we looked at last week. However, this release does contain interesting details, like the work-from-home data above.

Greece ran a current account deficit of 436 million euros in January, which was an improvement on the deficit of 1.29 billion euros in the same month of last year, according to Bank of Greece data.

Bank lending to the private sector continued growing in February. The annual growth rate of 3.7 percent was unchanged from January, while flows were also positive for the month, by 306 million euros. In January the monthly flow had turned negative, with a net decrease in lending of 549 million euros.

Private sector deposits also increased in February, by 741 million euros. That reverses a good chunk of the 1.19 billion-euro decline in January — a month when there’s always a seasonal drop in deposits.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key data

Tuesday:

March economic sentiment and consumer confidence (European Commission)

Wednesday:

January retail sales (Elstat)

Thursday:

March purchasing managers’ index (IHS Markit)

Elsewhere on the web

The IMF on how European banks can support the recovery

US financial plumbing is all of our financial plumbing, so it’s worth reading Chris Marsh’s latest on US Treasury issuance.

The bank effect and the big boat blocking the Suez.

While we’re on the subject, did I trawl Google looking for a Greek connection? Why of course I did. So here is a serendipitously timed piece from Greek Reporter on the islanders involved in its construction.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.