Macro roundup: Stabilisers on

Fiscal stimulus picks up pace again in July

A drum that I expect to keep beating this year is that we need to end the narrative that this year’s budget is a horror show. We should welcome the deficit, which shows the economy’s automatic fiscal stabilisers doing what they’re supposed to do.

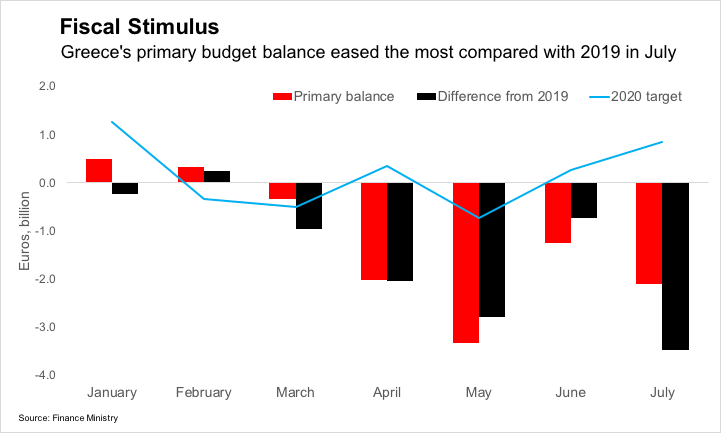

When we got the Finance Ministry’s update on the budget numbers for June, it looked like some of its support measures for the economy were running out of steam. These concerns were blown away when we got the July figures this week, as the year-to-date primary budget deficit came in at 8.2 billion euros.

The deficit for July on its own was 2.1 billion euros. While that was smaller than the deficit two months earlier, July is when first income tax instalments usually start getting paid, marking the start of a seasonal boost to revenue. Looking at the drop from the equivalent month of 2019, July saw the biggest fiscal easing so far this year.

This year’s budget is a write-off, but the country’s finances can absorb the hit. The worst damage would be if the government loses its nerve and panics. The good news is that the European Commission has said that the national budget rules will remain suspended in 2021, which gives Greece more time before it needs to shrink the deficit.

Debt management

Chris Marsh has written a compelling argument that given the euro is an imperfect monetary union, the government’s huge stock of deposits at the Bank of Greece serve as a substitute for reserve assets and monetary policy. Put differently:

Debt management is macroeconomic management in Greece.

A key takeaway from this argument is that the country should be issuing a lot more bonds than it is currently, while conditions remain favourable. That’s at odds with the government’s tentative approach to the bond market. The country’s last foray into the bond market was in June.

For anyone interested in Greek macroeconomics, I’d strongly recommend reading the piece, and then taking a look at the rest of his blog. It’s an invaluable resource for looking at Greece’s economy through the prism of its balance of payments.

Business update

Later today the Hellenic Statistical Authority will release data on the drop to businesses’ revenue in the second quarter. This month’s release will be interesting because the end of the quarter covers more businesses than the data we have available for April and May. However, other commitments mean I need to get this macro roundup out early today, so we’ll look at it next week.

Next week’s key data

Thursday:

Bank of Greece releases June balance of payments data

Friday:

Bank of Greece releases data on visitor numbers to Greece in June

Elsewhere on the web

Former ECB vice president Vitor Constancio has written about the return of fiscal policy to the euro area

Simon Wren-Lewis has a good blog post on the political economy and psychology of covid rebounds

Fiona Mullen of Sapienta Economics suggests a way out of the East Med geopolitical impasse

MacroPolis’s Agora podcast takes a look back at Greece’s first bailout

If you enjoyed this post, maybe share it with someone else you think might like it. I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.