Macro roundup: Slowing job growth

Greek unemployment still falling, but tougher environment could test labour market

Greece’s unemployment rate is continuing to trend lower, but there’s now a clear slowing of the trajectory from the middle of last year, when the country was exiting its second lockdown and gearing up for the tourist season.

The jobless rate dipped to 12.8 percent in February from an upwardly revised 12.9 percent the month before. February’s rate was the same as it was in December — but it’s a steep drop from April’s 17.5 percent rate, and is at its lowest since 2010.

As the government, central bank and official institutions revise down economic growth expectations this year due to the demand-dampening effects of inflation and the energy-crisis fallout from Russia’s invasion of Ukraine, the worry is that this will also lead to a slowdown in the labour market recovery.

The Labour Ministry this week released figures on hirings and departures for March. These show that the employment balance was positive in the month, with 34,373 more people starting jobs than leaving them. In March 2020 that figure was 19,161.

However, for the first quarter as a whole the hiring picture was a little more tepid. The employment balance was 23,758, compared with 48,732 in 2020, and it was the lowest total for the opening three months of the year since 2013 — with the exception 2020, at the outbreak of the pandemic.

Other data

The import price index in industry rose an annual 27.2 percent in February. In January, the increase was 31.8 percent.

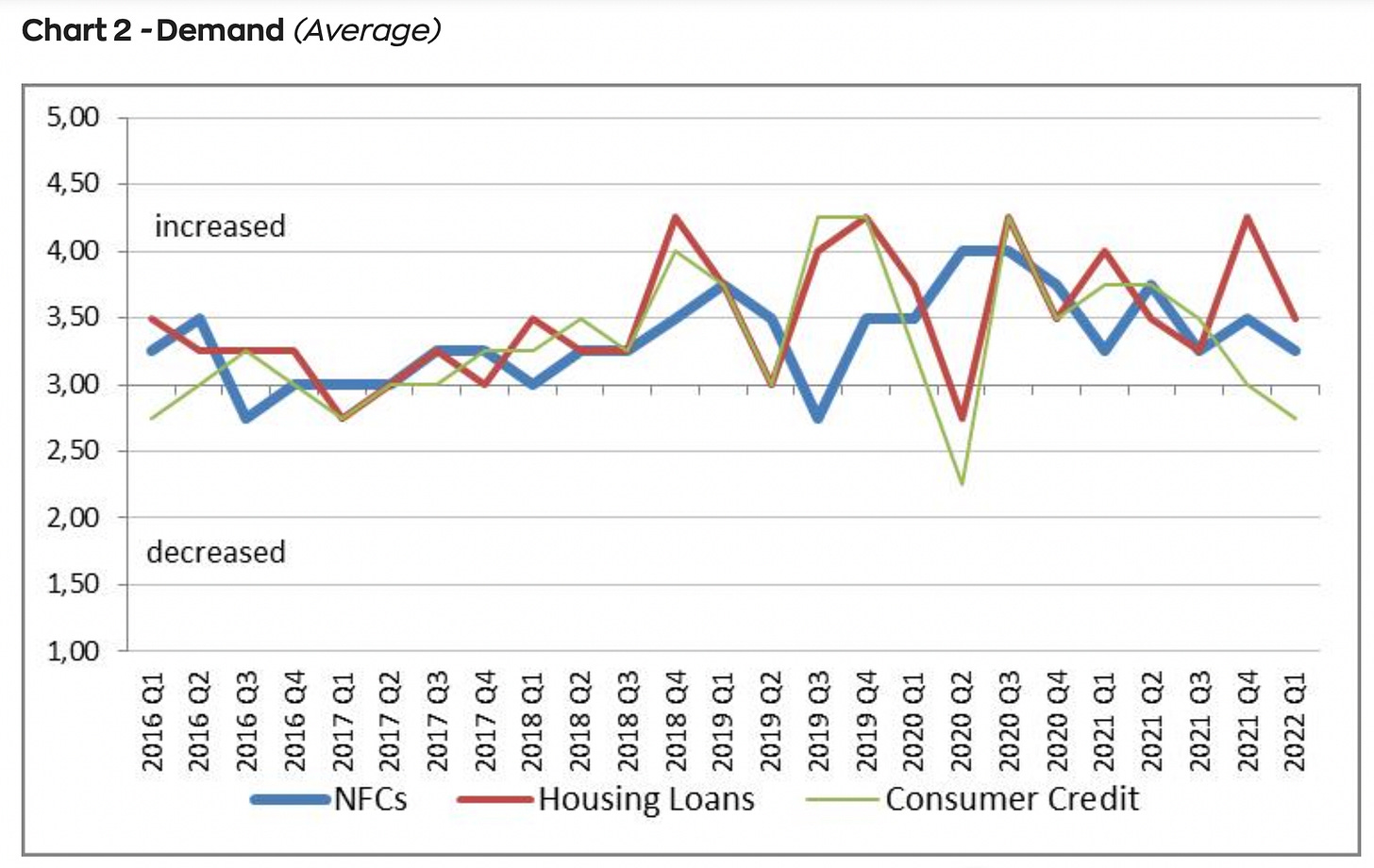

The bank lending survey for the first quarter suggests there may have been a slight weakening in demand for consumer credit. Based on survey responses from commercial lenders, demand for mortgages and business loans increased, but less than in the fourth quarter. The share of rejected applications for housing loans increased for a second straight quarter.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key releases

Tuesday, April 19:

Jan-March preliminary state budget execution (Finance Ministry)

Wednesday, April 20:

February balance of payments (Bank of Greece)

Thursday, April 21:

Fourth-quarter sectoral non-financial accounts (Elstat)

Elsewhere on the web

Bloomberg has an excerpt from Matthew Campbell and Kit Chellel’s upcoming book on the 2011 hijacking of the Brillante Virtuoso, an oil tanker owned by Marios Iliopoulos. Their original feature on this murder mystery was fantastic, so I expect their book, Dead in the Water, to be a real page turner.

I often link to Adam Tooze’s work in this section. Last week he was in Greece attending the Delphi Economic Forum. Here’s his take on the situation here as the country charts a course beyond the debt crisis.

Meanwhile, Jens van 't Klooster wrote an excellent paper on the political dynamics behind the ECB’s market-based treatment of government debt, which was such an important driver of the eurozone debt crisis.

Here’s a useful working paper, from a post-Keynesian monetary perspective, on the role of capital flows in the Eurozone's north-south divide.

An interesting explanation for why the EU’s energy policy has been such a mess for so long.

JW Mason questions why we see abundant liquidity as a danger. It comes from this broader symposium on the subject, featuring contributions from the likes of Jean-Claude Trichet, Mohamed El-Erian and Jim O’Neill, among others.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.