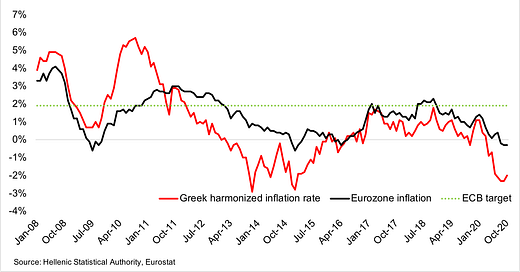

Macro roundup: Persistent deflation

ECB has no excuse not to throw caution into the wind with stimulus

As next month’s European Central Bank policy meeting promises to deliver a new round of monetary stimulus in light of renewed lockdowns, it’s a good time to check in on the latest inflation data.

Data on Tuesday show Greece’s consumer price index dropped 2 percent in October, with prices falling 0.3 percent for the eurozone as a whole. Prices are so far below the ECB’s target of inflation of just under 2 percent that there’s no excuse not to throw caution into the wind in order to help households get through the crisis.

The debate ahead of next month’s meeting is revolving around how much stimulus should come from the PEPP programme, or quantitative easing, and how much from should come from more TLTROs, where the ECB effectively pays banks to borrow from provided they meet targets for lending to the real economy.

While there are advantages and disadvantages to either approach, this debate masks a failure of EU policy-making in general — mostly at the fiscal level — to funnel enough financial support directly to households.

Virus update

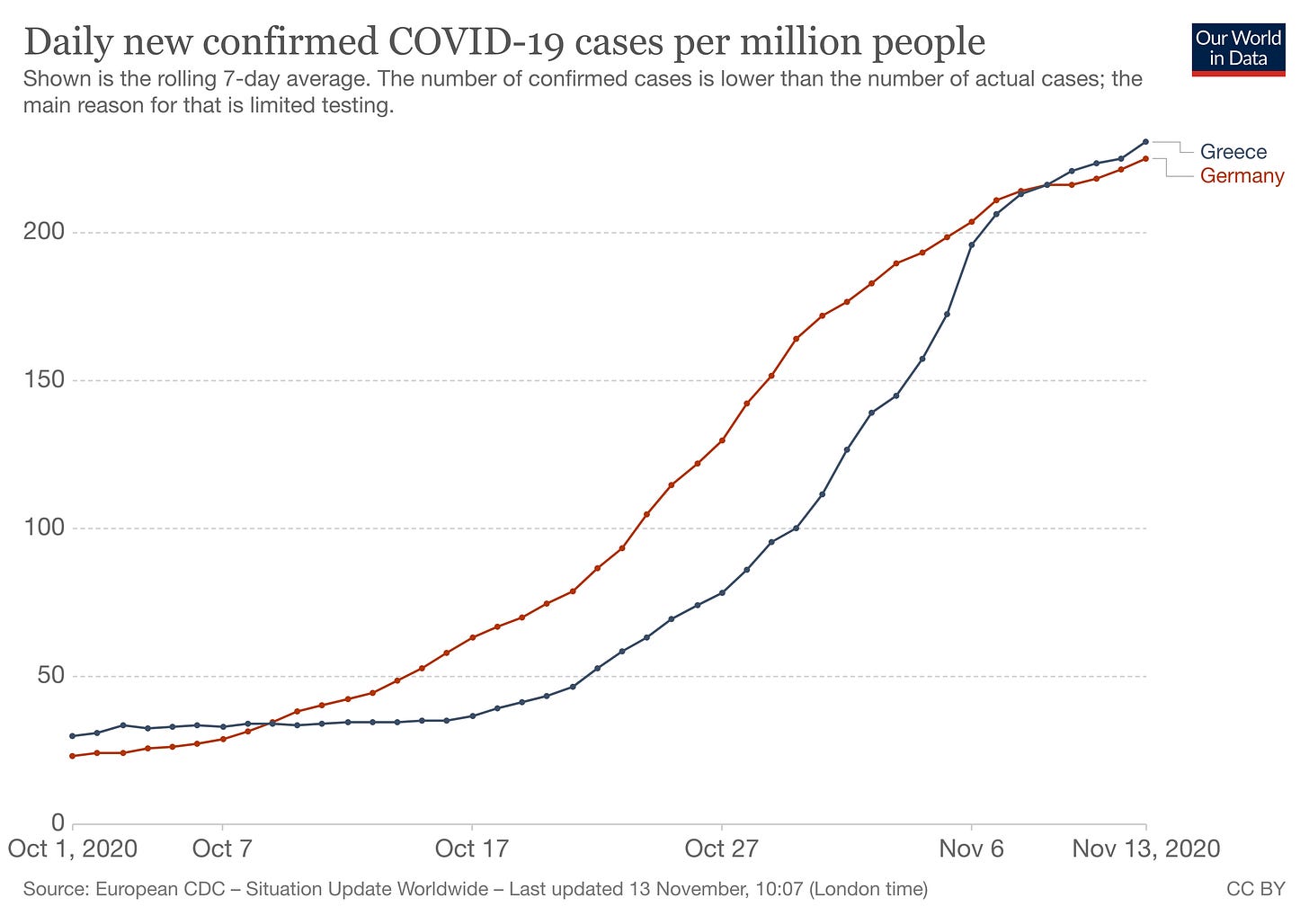

That policy failure has led to the false trade-off between public health and the economy that has helped make the EU the current epicentre of the pandemic. We had a look last week at the growth in cases, and given how important this is to the economy’s outlook we should continue to check in on these figures.

Last week I noted that the slope of Greece’s curve suggested it was on course to overtake Germany. That happened, and with fresh records being set in the numbers of cases, the outlook is pretty bleak. The one consolation is that that curve is now less steep than it was then, and with the fresh tightening of the lockdown measures, we’re hopefully near the peak.

That looks to be the case for the EU as a whole, where lockdowns have brought the outbreaks under control in several countries. Austria seems to be where the trend is most alarming right now.

Other data

Industrial production fell an annual 2.4 percent in September, with manufacturing decreasing 4 percent. On a monthly basis, the index rose 1.4 percent, though manufacturing still fell 0.4 percent. This fits with PMI data suggesting the sector was yet to recover before the second lockdown.

Building activity in August, measured by number of new building permits, fell 3.3 percent from a year earlier. For January to August, activity increased 13.7 percent.

The market for Greek debt got a boost as Moody’s increased Greece’s credit rating from B1 to Ba3 with a stable outlook.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key data

Monday:

January-October central government budget execution (Finance Ministry, probable date)

Wednesday:

September data on business revenue (Elstat)

Friday:

September balance of payments (Bank of Greece)

Elsewhere on the web

Dimitris Valatsas hits the nail on the head when he argues in Foreign Policy that the U.S. got its economic response to the pandemic right by spending early and spending big. Europe is fluffing it!

And then there’s Turkey, where economic crisis makes for awkward family dinners in the Erdogan household

The government is offering big tax breaks for “digital migrants”

From Bruegel, monetary policy in the time of covid

National Bank of Greece’s tracking of high-frequency data sees them predict a quarterly GDP contraction of 5.1% next quarter

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.