Macro roundup: Money gets tight

Greek deposits shrank in February; credit growth slowed

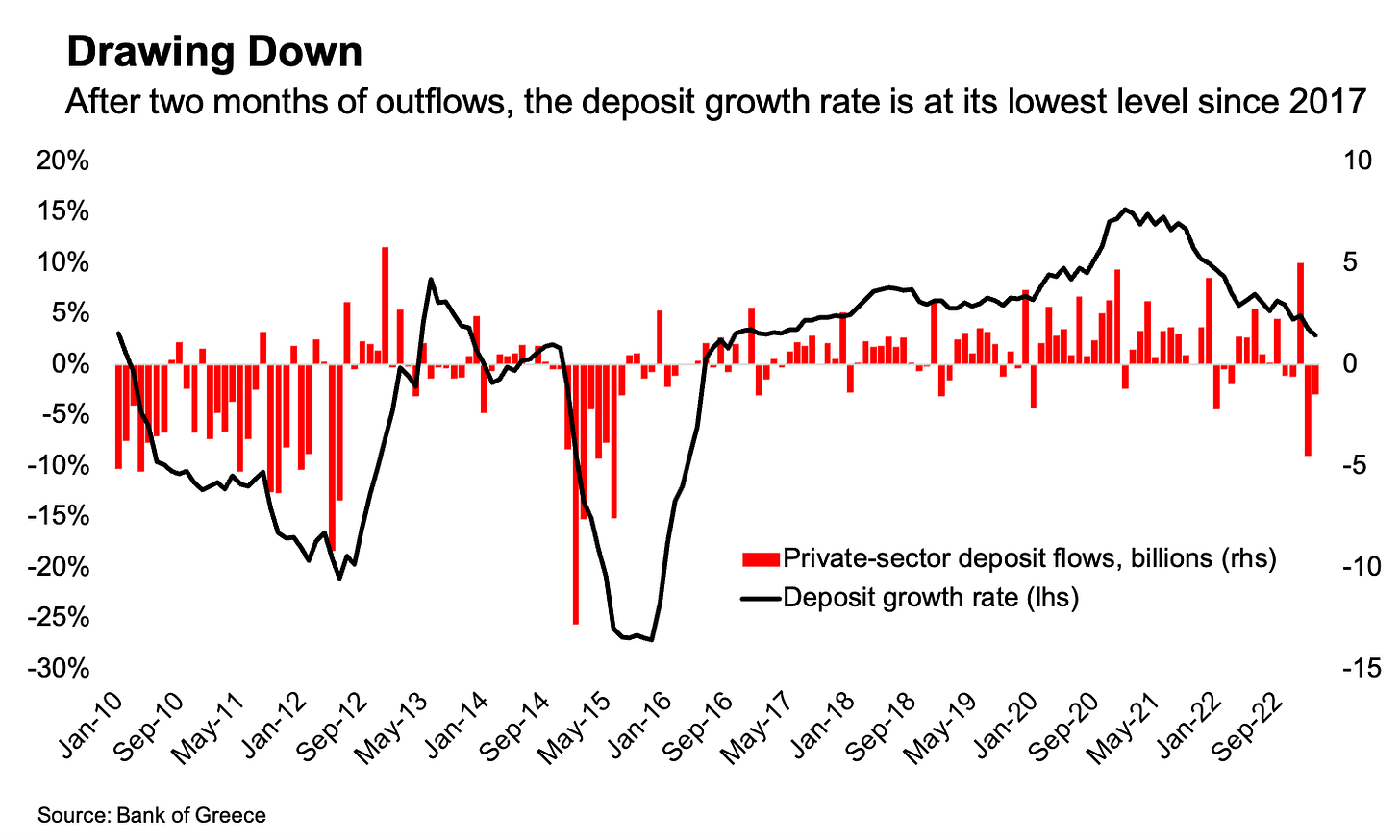

Private sector bank deposits in Greece shrank by 1.45 billion euros in February, totalling a 6 billion-euro decrease since the start of the year. That’s the biggest two-month drop since the crisis of 2015, and perhaps a sign of the European Central Bank’s monetary tightening effects.

To be sure, there’s some degree of seasonality in Greece’s deposit flows; a drop at the start of the year is expected. Although January’s decline was the biggest for eight years, it came a month after an even bigger deposit inflow.

Nevertheless, taken in context, such a significant drop could prove to be the start of a new trend, one that probably accelerated in March given the negative headlines about banks in the United States and elsewhere in Europe.

For wider euro-area context, Frederik Ducrozet is one of the best economists to follow. Here’s a twitter thread he wrote earlier in the week, which notes that money supply growth is dropping faster than expected.

On the credit side, lending growth to Greek households and businesses slowed to 4.8 percent in February from 5.7 percent the month before. That breaks down to a 9.7 percent annual growth rate for non-financial corporations, down from 10.6 percent in January, and a 2.5 percent credit contraction for households.

Meanwhile, the interest rate spread between new loans and deposits — which was already at a euro-era record in January — widened 12 basis points to 5.36 percent in February. Lending rates continued to escalate rapidly, with the weighted average rate for new loans rising to 5.57 percent from 5.36 percent.

Although deposit rate increases continue to lag, the rise in the weighted average rate to 0.21 percent from 0.12 percent in February is the biggest increase in over a decade.

Refined and crude calculations

I wrote a follow up to last week’s roundup noting the sharp improvement in Greece’s terms of trade last year. In the follow up, I explore whether this can be accounted for by the price of refined petroleum exports growing faster than the price of crude oil imports. In case you missed it, here it is:

Other data

Greece’s seasonally-adjusted unemployment rate rose to 11.4 percent in February from 10.3 percent in January. The rate stood at 13 percent in February 2022.

Economic sentiment in Greece dipped slightly in March, seemingly thanks to a drop in industry confidence, according to the European Commission’s indicator. At the same time, consumer confidence improved in the month.

Building activity, as measured by the number of permits issued, increased 5 percent in 2022 compared with 2021. For the medium-term trend, here’s a nice chart Elstat’s press release:

Retail sales increased 10.8 percent in January from a year earlier, while retail volume rose 1.4 percent.

If you are enjoying this newsletter, then consider sharing Grecology with others.

Next week’s key releases

Monday, April 3:

March manufacturing PMI (S&P Global)

Friday, April 7:

February commercial transactions (Elstat)

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by replying to the email. If you’re not subscribed yet, consider doing so.