Macro roundup: Inflation slows

Greek CPI growth decelerates; core price increases remain thorny

Greece’s inflation rate fell to a one-year low in January, an encouraging sign that the price shocks of the last couple of years will still prove “transitory”.

The country’s consumer price index, which uses a national methodology, fell to 7 percent from 7.2 percent in December. The EU-harmonised index of consumer prices fell 0.3 percentage points to 7.3 percent, which compares with a rate of 8.5 percent for the euro area as a whole.

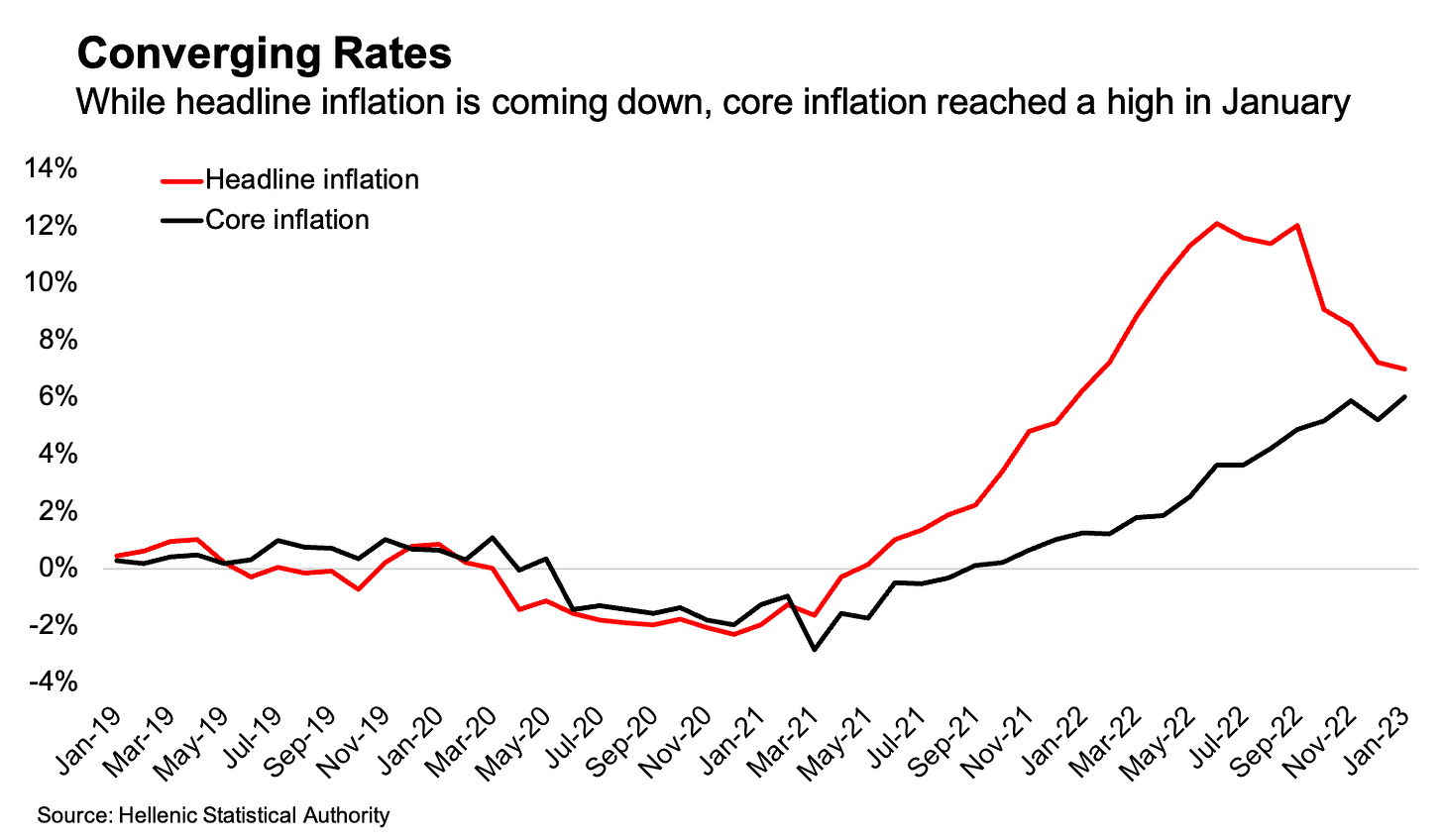

Core inflation, which strips out volatile items like energy and food, rose to 6 percent in January from 5.2 percent the month before. So while the headline rate is at its lowest since January 2022, core is the highest it's been during this inflationary episode.

A pessimistic view might be that although the headline rate is coming down from its highs, it could still settle around the 6 to 7 percent. Since European Central Bank policy makers tend to look at core inflation as a better indicator of price dynamics than the headline rate, this perspective explains the ECB’s continuing hawkishness.

This outlook feels a little too bleak to me. The energy price shock drove headline inflation higher and core followed with a lag — and it would take another lag before headline inflation drives core down. But a deeper dive into the inflation breakdown between components will wait until a future post.

For now, some perspective on the difference between persistent and transitory inflation: Greece’s headline inflation rate stayed continuously in double digits for 22 years after the 1973 oil price shock. During this latest episode, inflation stayed in double digits for six months.

Other data

Greece’s central government posted a primary budget surplus of 2.77 billion euros in January, better than the target of 2.15 billion euros

Revenue of 7.16 billion euros beat its target of 6.59 billion euros, thanks to tax receipts coming in 620 million euros higher than budgeted

Expenditure came to 5.69 billion euros, just 12 million euros above target

If you are enjoying this newsletter, then consider sharing Grecology with others.

Next week’s key releases

Monday, Feb. 20:

December balance of payments (Bank of Greece)

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by replying to the email. If you’re not subscribed yet, consider doing so.