Macro roundup: Household resilience

Private sector balance sheets have strengthened during the crisis

Greek household and business deposits are continuing their welcome growth this year, increasing another 2.5 billion euros in October.

The latest increase was reportedly helped by the government paying out pensioners’ backpay following a ruling by the country’s Supreme Court. But it’s still part of a march upwards that has seen total deposits increase 13.4 billion euros since February, the last month before the pandemic really started to impact the economy.

The stock of household and business deposits now stands at 155.7 billion euros and within 8.6 billion euros of the level they were at before the eight-month bank run that began at the end of 2014.

As we saw recently, a large part of this increase is because the plunge in household consumption has even greater than the fall in income. Still, the resilience of private sector balance sheets is testament to the fact that fiscal and monetary policy haven’t worked to exacerbate the current crisis like they did the previous one.

This year, Greece has seen the return of the “dreaded twin deficits” of a rising imbalance in the country’s current account and the government’s budget. But it is precisely because these two gaps have been allowed to grow that the domestic private sector — the third leg of this stool — is surviving with its financial position intact.

Other data

Bank lending to the private sector continued expanding annually in October, growing 2.5 percent compared with 2.4 percent in September. However, the net flow for the month was negative — with credit contracting 247 million euros — for the first time since April.

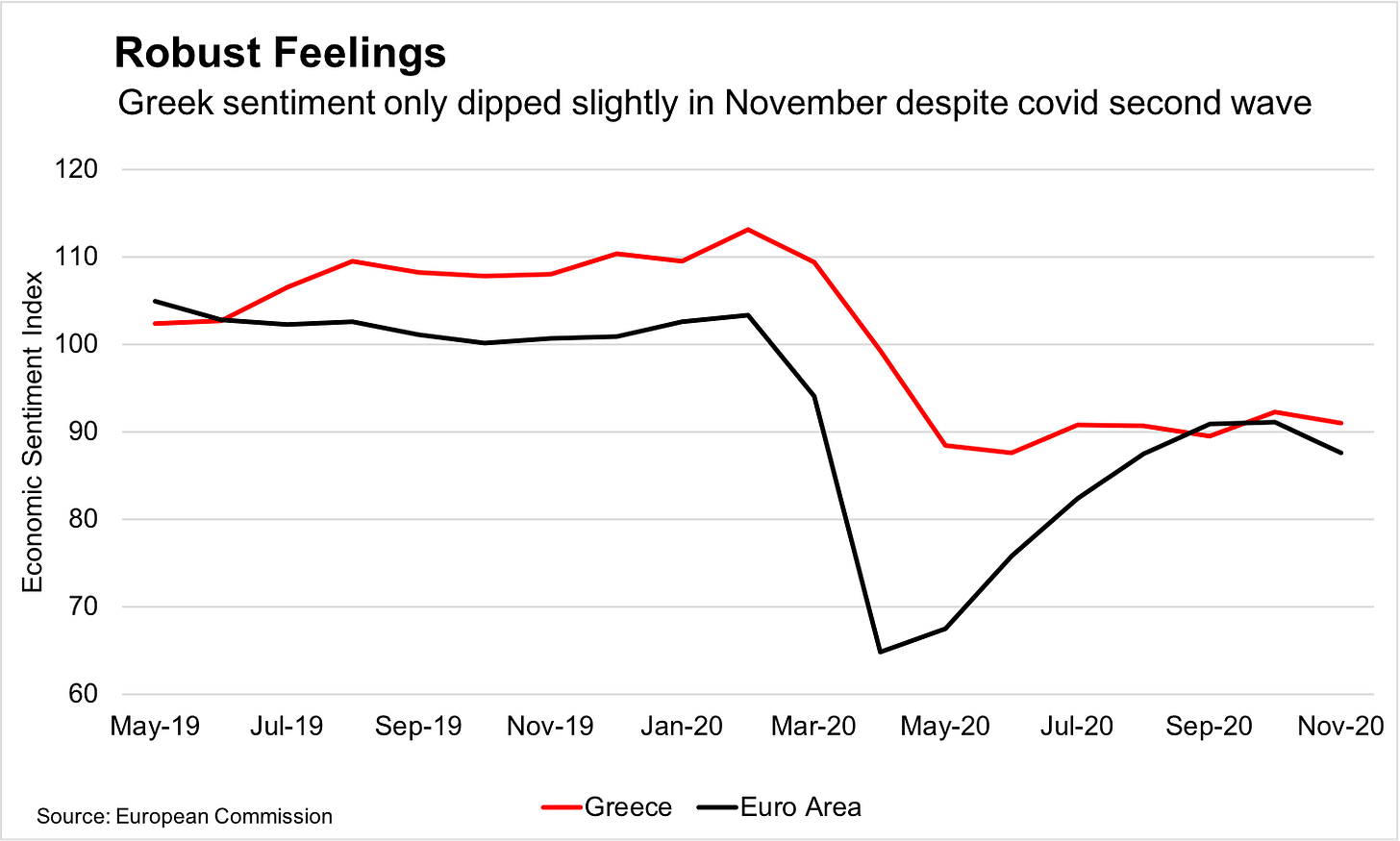

Greece’s Economic Sentiment Indicator dipped slightly in November, but less than for the euro area as a whole, and still remained above September’s level.

The final figures for the central government’s primary deficit from January to October was 9.1 billion euros, in line with the preliminary estimate.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key data

Monday:

September retail sales (Elstat)

Tuesday:

November manufacturing PMI (IHS Markit)

Friday:

Third quarter gross domestic product data (Elstat)

Elsewhere on the web

The government published its draft proposal for how it will spend the funds it receives from the EU’s Recovery and Resilience Facility

Bank of Greece governor Yannis Stournaras wrote an op-ed in Handelsblatt arguing for a change to the EU’s bank resolution framework

Greece is behind a “rescue mission to save Stonehenge”

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.