Macro roundup: Growth run ends

Inventories caused Greece's first quarterly GDP drop since 2020

After a great deal of fanfare about Greece’s economic growth outpacing the euro area average last year, gross domestic product contracted 0.1 percent in the first three months of this year from the previous quarter. It was the first quarterly fall in GDP since the second quarter of 2020, when the country was in lockdown.

Last week we noted that inventories were likely to act as a drag on economic growth this year after a big build up in 2022.

An aspect of last year’s strong economic growth that hasn’t been remarked on much is the extent to which changes in inventories were an important driver — contributing 2.4 percentage points to the 5.9 percent increase in gross domestic product. That’s likely to prove a drag on growth this year as inventories adjust — unless the experience of the supply chain bottlenecks of 2021 and early 2022 caused a structural shift whereby firms want to hold more stock. The PMI report that managers want to run down stocks gives us an anecdotal hint that we’re not seeing a structural shift.

That’s exactly what happened in the first quarter, as every expenditure component of of GDP added to overall growth except for changes to inventories and fixed investment. Of these two components, inventories were by far the more important, subtracting 6.6 percentage points from the quarterly change in GDP.

Much of this was counterbalanced by a 5.5 percentage-point boost from the external balance — split equally between a rise in exports and a fall in imports.

The 0.1 percent contraction in the first quarter is exactly the same as the eurozone average. However, Greece is not technically in a recession like the euro area is — the onset of a recession is defined by two consecutive quarter-on-quarter contractions — since Greek GDP expanded a revised 1.1 percent in fourth quarter of 2022.

On an annual basis, Greece’s GDP expanded in 2.1 percent in the first quarter from the same quarter of 2022, down from 4.8 percent in the previous quarter. That’s still higher growth than in the euro area as a whole, where year-on-year growth was 1 percent in the first quarter.

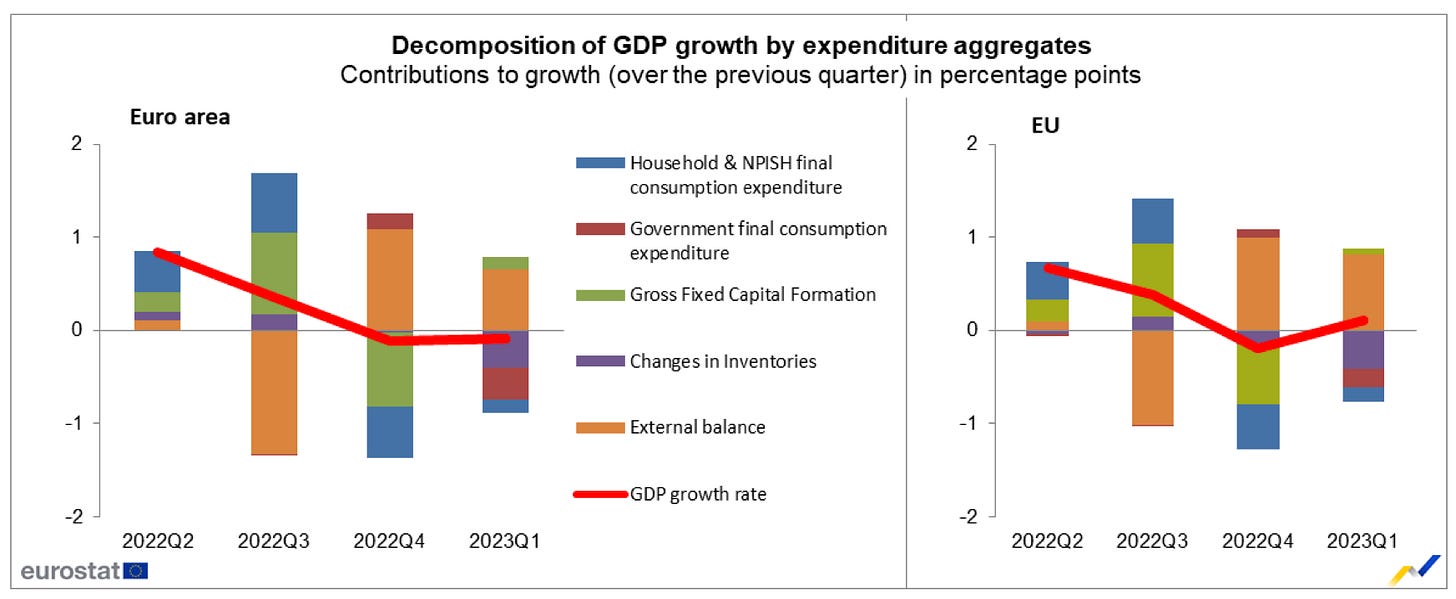

As with Greece, changes in inventory was a major driver of the euro-area quarterly contraction. Unlike Greece, however, the rest of the currency bloc didn’t see the same inventory build up in the preceding quarters.

Paying back growth

In GDP accounting, inventories represent goods produced in a time period that don’t reach their final consumer in that same time period. So if a widget is produced in the fourth quarter, but is still sitting in a warehouse in on December 31, that will show up in GDP as an increase inventory. If it’s then purchased by its ultimate user when shops open on January 2, this will show as an increase in final consumption in the first-quarter accounts, but it will be offset by an equal decrease in inventories, so the net effect on GDP is zero.

In effect, GDP growth that’s driven by large increases in inventory is like “borrowing” from future GDP growth. This is what we are seeing in the first quarter data. In a sense, it means that the economy contracting in the first quarter isn’t as bad as it seems at first, but that interpretation holds only if we also acknowledge that last year’s growth rate wasn’t as impressive as it looked either.

Of course, there’s also another element to this, which is that large inventory build-ups can indicate that final demand is weaker than businesses had planned for. This in turn might be a leading indicator of a coming slowdown. When the business cycle turns, businesses draw down inventories and this amplifies the downturn. In general, inventories are seen as a volatile and pro-cyclical component of GDP, responsible for amplifying business cycles.

It could be that this is also what we’re seeing here. However, it’s worth remembering that we’re coming through a highly unusual economic period with the pandemic followed by supply-chain bottlenecks. It’s natural that firms will overcompensate, stockpiling goods and materials, as this process works itself out. Some caution is needed in trying to draw textbook conclusions from the patterns showing up here.

Interest margins keep spreading

The spread between the interest rates that banks charge on new loans and those they give for new deposits — which was already at a record highs for several months — widened another 10 basis points to 5.6 percentage points in April.

Last week, we noted that in the first four month of 2023 there was a notable rotation of people moving deposits out of overnight accounts and into term savings accounts, with longer maturities, to take advantage of rising interest rates.

The increase in average interest rate for deposit accounts with agreed maturities up to one year may be small compared with the increase in banks’ lending rates, but it rose to 1.22 percent in April from 1.16 percent the month before and 1.04 percent in February.

By contrast, the average interest rate on overnight deposit accounts actually decreased — from 0.03 percent to 0.02 percent.

Other data

Inflation continued to decelerate in May as consumer prices rose 2.8 percent from a year earlier, compared with 3 percent in April

Prices for food and non-alcoholic beverages increased 11.6 percent from a year earlier

Greece’s EU-harmonised inflation rate fell to 4.1 percent from 4.5 percent the month before

Industrial production increased 4.2 percent in April from a year earlier, up from 0.1 percent in March

Manufacturing increased 3.2 percent; electricity supply rose 9.9 percent

It’s the first time since July 2022 that overall industrial production rose more than manufacturing

Greece’s trade deficit shrank 23.1 percent in April compared with the same month a year earlier as imports fell by more than exports

Imports fell 11.8 percent to 6.12 billion euros; exports dropped 4.3 percent to 3.95 billion euros

Next week’s key releases

Wednesday, June 14:

April import price index in industry (Elstat)

Thursday, June 15:

January-May preliminary central government budget execution (Finance Ministry)

First-quarter labour force survey (Elstat)

Friday, June 16

First-quarter wage cost index (Elstat)