Macro roundup: Growing energy bill

Higher oil prices are taking a toll on Greece's current account balance

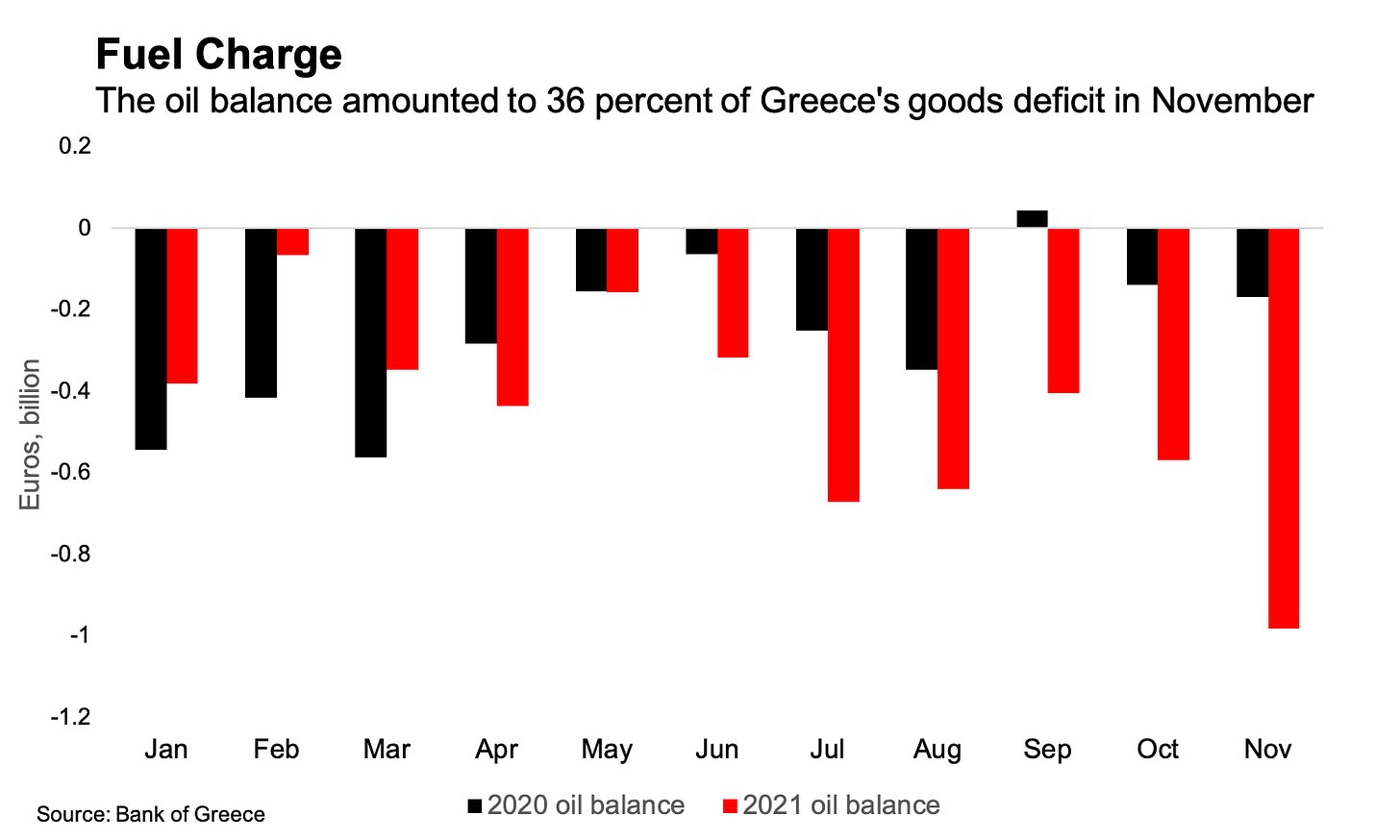

Greece’s current account deficit doubled in November compared with the same month of 2020 as the high price of oil made its impact felt on the external accounts.

For the first 11 months of 2021, the current account deficit came to 8.9 billion euros, narrowing from 10.3 billion euros the year before. The gap that remains when comparing this cumulative period with 2019 — when the deficit came to 2.2 billion euros — remains mostly down the pandemic’s impact on tourism.

The relatively strong rebound in tourism last summer was a major contributor to the economic rebound in the third quarter, but revenue still remains well down from its record high in 2019. Travel receipts of 10.5 billion euros between January and November represented a drop of 7.4 billion euros from two years previously.

But the toll of high oil prices on the current account is a trend that became much more pronounced in the second half of the year.

The 2.5 billion-euro current account deficit for the month was the widest November deficit seen since 2009, and it was driven by a 2.7 billion-euro deficit in the goods balance. The deficit in the balance of exports and imports of oil products was 982 million, accounting for more than a third of the goods deficit.

To round off this section, this is a great chart from @MacroTragedy charting the trajectory of the current account in each of the last three years:

Other data

The seasonally-adjusted unemployment rate edged down to 13.3 percent in November, from 13.4 percent in October.

The Finance Ministry’s December budget execution figures for the central government showed that the primary deficit last year came in at 11 billion euros. That’s a reduction from 18.2 billion euros in 2020, and not far from the initial 2021 budget target of 10.3 billion euros.

Greece’s general government debt increased to 357 billion euros in the third quarter — the most since the 2012 bond restructuring — from 354 billion euros in the second quarter, according to Elstat figures released today. I wrote more yesterday on how debt reduction will be a central theme for this year:

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key releases

Tuesday, Jan. 25:

2021 central government budget execution, final figures (Finance Ministry)

Wednesday, Jan. 28:

Third-quarter non-financial accounts (Elstat)

Friday, Jan. 28:

December bank lending and deposits (Bank of Greece)

January economic sentiment index (European Commission)

October building activity survey (Elstat)

Elsewhere on the web

On the debt reduction debate, a warning that a post-pandemic return to fiscal orthodoxy should not be allowed to bring about a return to austerity.

A proposal from the European Fiscal Board stakes out the ground where the reformed Stability and Growth Pact is very likely to settle on. Here’s a contribution this week co-authored by one of the board’s members.

Maria Demertzis argues that the reformed fiscal framework should include a permanent but targeted role for the Recovery and Resilience Facility.

Adam Tooze argues that Mario Draghi may not have the solutions to Italy’s problems, whether as prime minister or as president.

Staying with Tooze, he also has a useful roundup of Germany’s inflation debate.

Public service announcement for Greek readers who live abroad: you will soon be able to pay your taxes using foreign credit and debit cards. (I have no idea if any of my readers own yachts, but mooring levies too.)

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.