Macro roundup: Greece's external position

Oil balance worsens in March; FDI inflow slows after record year; building activity drops

Greece’s current account position continued to improve in March, though by less than the amount of the first two months of the year.

The current account deficit shrank to 3.85 billion euros in the first quarter, compared with 6.98 billion euros in the first three months of 2022. Funds from the European Union’s Recovery and Resilience Facility, recorded under the secondary income account, significantly boosted the current account in both January and March.

Without the primary and secondary income accounts, the balance of goods and services improved by 66.5 million euros in March, compared with 1.76 billion euros for the first quarter as a whole. Moreover, the oil balance worsened in March from a year earlier, following improvements in each of the previous two months.

That was because oil exports fell 11.9 percent in March to 1.19 billion euros, while oil imports grew 8.6 percent to 1.9 billion euros. For the first quarter overall, oil exports grew 30.8 percent as oil imports grew 2.1 percent.

Mean reversion

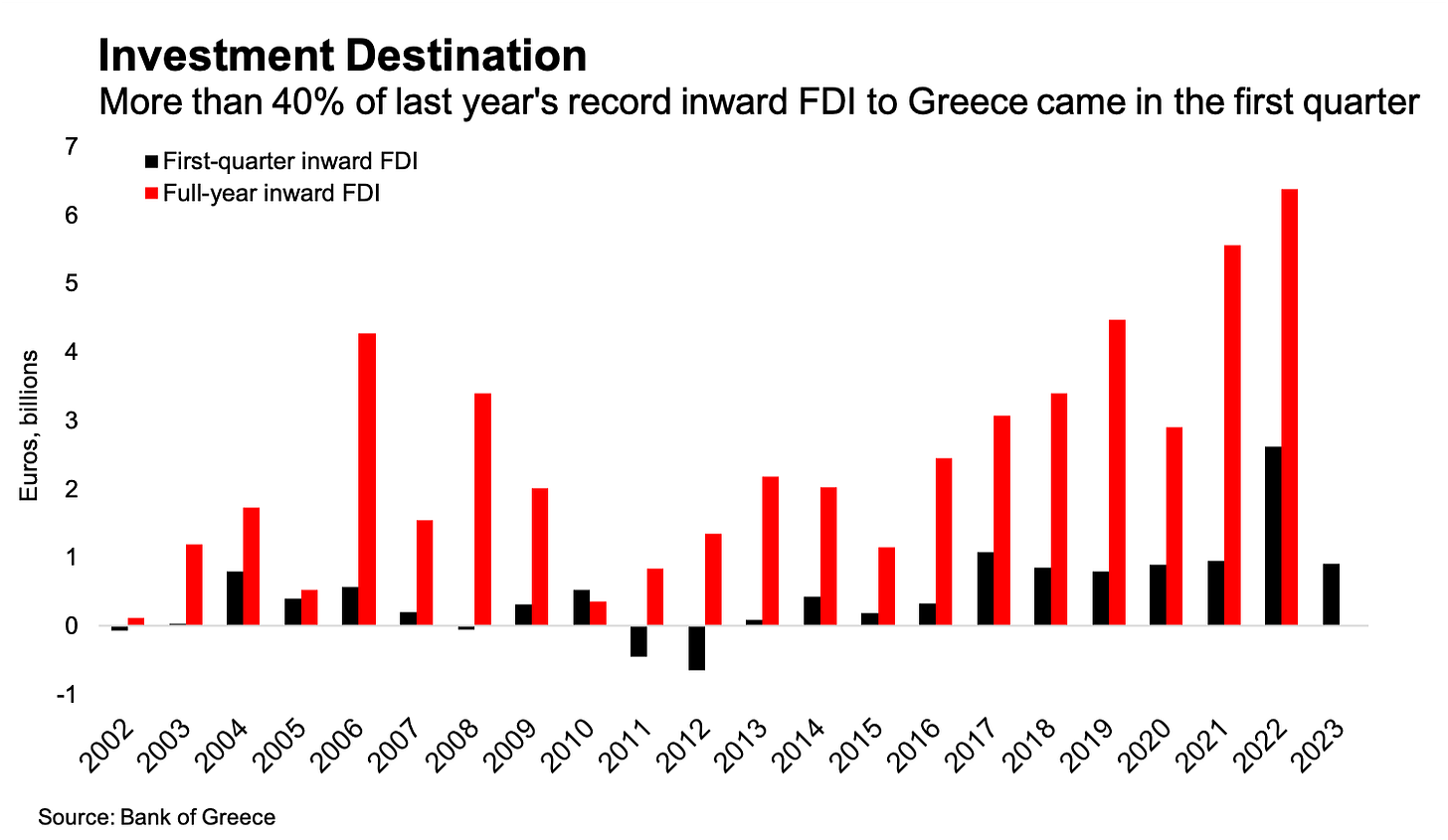

One notable feature of the financial account of the balance of payments has been the upward trend in foreign direct investment into Greece, reaching a record 6.38 billion euros last year, most of which was from real estate transactions and mergers and acquisition activity. Much of it came early in 2022; 41 percent of the total — or 2.62 billion euros — took place in the first quarter.

So far this year, the amount of FDI has been far more in line with previous years. Inward FDI amounted to 910 million euros, just over a third of the previous year’s amount and also slightly lower than the 956 million euros that took place in the first quarter of 2021.

If it transpires that 2021 was the high-water mark for volume of FDI into Greece, there’s still scope for qualitative improvement if future FDI becomes more concentrated in greenfield investment.

Other data

Building activity in Greece, as measured by the number of permits issued, fell 15.8 percent in February from the same month a year earlier.

Surface area dropped 14.2 percent; volume decreased 21.7 percent

The central government posted a primary budget surplus of 2.44 billion euros in the first four months of 2023, compared with a target deficit of 869 million euros.

Net revenue of 21.1 billion euros was 2.51 billion euros higher than target

Post-election roundup

Prime Minister Kyriakos Mitsotakis’s landslide victory in Sunday’s election has been seen as a huge positive for markets, investment and the economy. Assuming there’s no major upset in the next election, scheduled for June 25, an upgrade to investment grade from one of the credit ratings agencies is likely to follow within weeks of that.

But some are sounding notes of caution.

Yannis Stournaras, who a few weeks ago was calling on political parties to rein in their spending promises, this week wrote an oped piece in Kathimerini talking about the need to make sure that Greece’s recovery isn’t derailed. In particular, he flagged concern about the size of the country’s current account deficit, and the need to use primary fiscal surpluses to build up special reserves that aren’t distributed in the form of handouts.

The European Commission also released recommendations for Greece this week, calling on it to contain expenditure and to address structural weaknesses in the economy.

Meanwhile, Theodore Pelagidis was today sworn in as finance minister in the interim government that will be in place for the next few weeks. Pelagidis, an academic economist and the deputy governor of the Bank of Greece, will be in place as the European Commission evaluates Greece’s request for RRF fund disbursements.

Next week’s key releases

Tuesday, May 30:

April bank lending and deposits (Bank of Greece)

May economic sentiment (European Commission)

Wednesday, May 31:

March retail sales (Elstat)

Thursday, June 1:

April unemployment (Elstat)

May manufacturing PMI (S&P Global)