Macro roundup: Breaking the dam

Inflation continued to surge in February, and faster monetary tightening is on the way

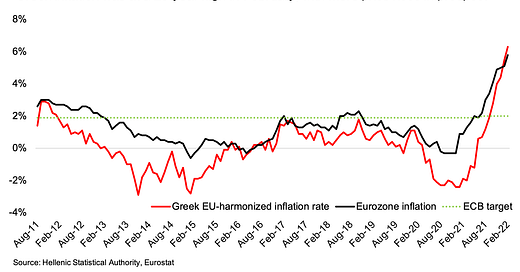

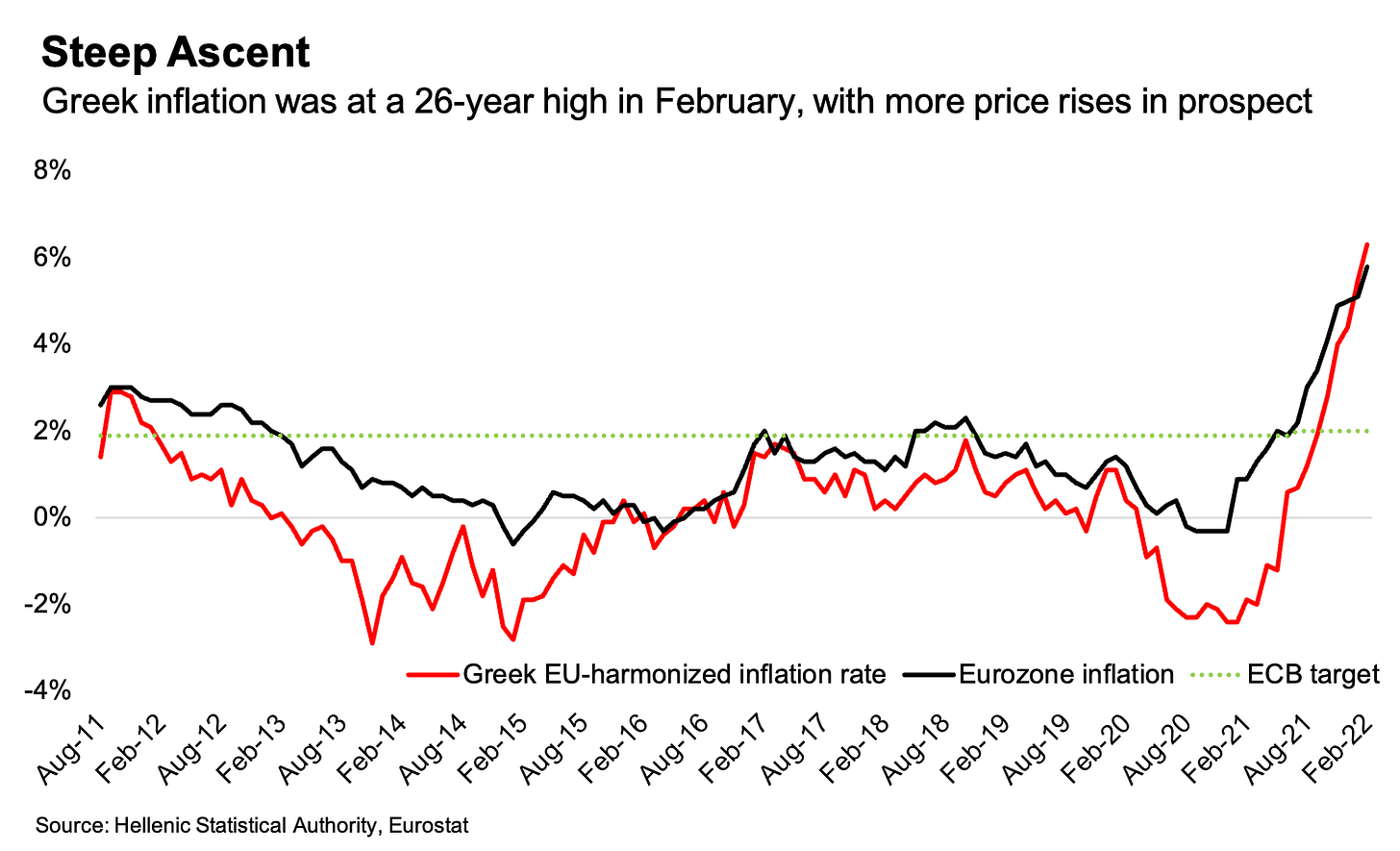

Greece’s February inflation numbers that came out yesterday were slightly terrifying.

It’s not just that the annual increase in national consumer price index came in at 7.2 percent — an increase from 6.2 percent in January, and the highest since 1996 — with the EU-harmonized rate increasing 6.3 percent. These number largely reflect the situation before Russia unleashed its war on Ukraine, with the further deterioration that the economic fallout from this aggression will bring.

But what I find even scarier is that the sense of euro-area inflation spiralling out of control seems to have broken the dam at the European Central Bank, which started the year as more dovish than other major central banks. Yesterday’s ECB policy meeting marked an abrupt change, with hawks on the Governing Council getting the upper hand.

The quotes in the FT the story are indeed striking. The quote that alarmed me even more was this one:

“The argument about inflation dominated and prevailed over anything else, including the war, the uncertainty and the fears about growth,” said one person involved in the meeting.

Something-Must-Be-Done-ism appears to be gaining the ascendency among the ECB’s policy-making officials — but it’s hard to see how central bank tightening will actually bring down inflation other than if it engineers a recession. This is starting to feel a bit like when the Trichet ECB hiked rates in 2011 with the euro-zone in crisis.

A few weeks ago, I linked to a post by Duncan Weldon that asks how policy makers will remember 2020. There was a passage in that which was spot on, and which I think deserves quote in full:

The story of ‘aggressive fiscal and monetary policy prevented a depression’ is morphing into ‘aggressive fiscal and monetary policy lead to the highest inflation in three decades’.

For what’s worth, I don’t think that interpretation is at all fair. The counterfactual world in which policy had not responded as it did would be grim. Inflation might well be materially lower but unemployment would be a much more pressing problem, business failures would have soared and, in the face of mounting economic costs, many countries would no doubt have dropped social distancing well before the vaccines arrived leading to more deaths.

But stories do not have to be either fair or true to have power. A year ago I assumed that whenever the next recession came along that, guided by the lessons of 2020, the policy response would be more aggressive. Now I am not so sure at all.

The response to the current crisis seems to validate that worry.

We’ll get more nuance in the coming days as policy makers start to speak. Hopefully there’ll be more signals like these from today:

Other data

Greek industrial production dropped 0.2 percent in January from a year earlier, the first decrease in 15 months, which might have been due to bad weather given that month’s snow storm.

This was led by a 21.5 percent decrease in mining and quarrying, with electricity supply also falling 6.7 percent. The manufacturing index increased 2.6 percent.

If you’re enjoying this newsletter, consider sharing it with others who might also like it.

Next week’s key releases

Monday, March 14:

January import price index in industry (Elstat)

Tuesday, March 15:

January-February central government budget execution (Finance Ministry)

Wednesday, March 16:

January unemployment (Elstat)

Thursday, March 17:

Fourth-quarter unemployment (Elstat)

Elsewhere on the web

Some companies are temporarily shutting down because of soaring energy prices, according to Kathimerini.

The newspaper is also reporting that the government is reviewing Greece’s energy strategy again. This will probably slow down the transition away from lignite coal, while nuclear could also come into the mix in the form of imports from Bulgaria.

Bruegel on the economic policy consequences of the war.

Nektarkia Stamouli reports on the existential economic question facing Cyprus, which has spent decades courting Russian business.

I’d love to get your thoughts and feedback, either in the comments, on Twitter or by reply if you received the newsletter by email. If you’re not subscribed yet, consider doing so now.